Every new strain is another bump in stock value

The vaccine business is booming.

Never forget that on all of these various agendas, someone is making money.

Major COVID-19 vaccine maker Moderna posted a more than 13-fold increase in total revenue in 2020, compared to 2019, the company revealed in an earnings report on Thursday.

“Total revenue was $803 million for the year ended December 31, 2020 compared to $60 million for the year ended December 31, 2019,” the report said, adding that much of the change is linked to the company’s coronavirus vaccine, mRNA-1273.

“The increases in [the fourth quarter of 2020 and the full year] were driven by increases in grant revenue and product sales,” the report continued. The rise in grant revenue came primarily from an award by the federal Biomedical Advanced Research and Development Authority (BARDA), it said.

The U.S. government has pledged over $500 million to aid the development of mRNA-1273and claims a stake in the intellectual property, Axios reported last year. Moderna “retains worldwide rights to develop and commercialize” the jab, Thursday’s report noted.

“We began to recognize revenue in December 2020 from our COVID-19 vaccine subsequent to its authorization for emergency use by the FDA and Health Canada,” the report added, announcing nearly $200 million in product revenue in 2020. mRNA-1273is the only product that Moderna has brought to the market.

The coronavirus vaccine also helped boost the company’s market capitalization by more than $50 billion and skyrocket its share price over 700% last year. Morgan Stanley has estimated that roughly half of the new value is due to the vaccine.

The rapid growth of Moderna, a previously little-known Massachusetts-based startup, has turned at least three shareholders into billionaires so far, with top executives cashing out almost $100 million by May alone.

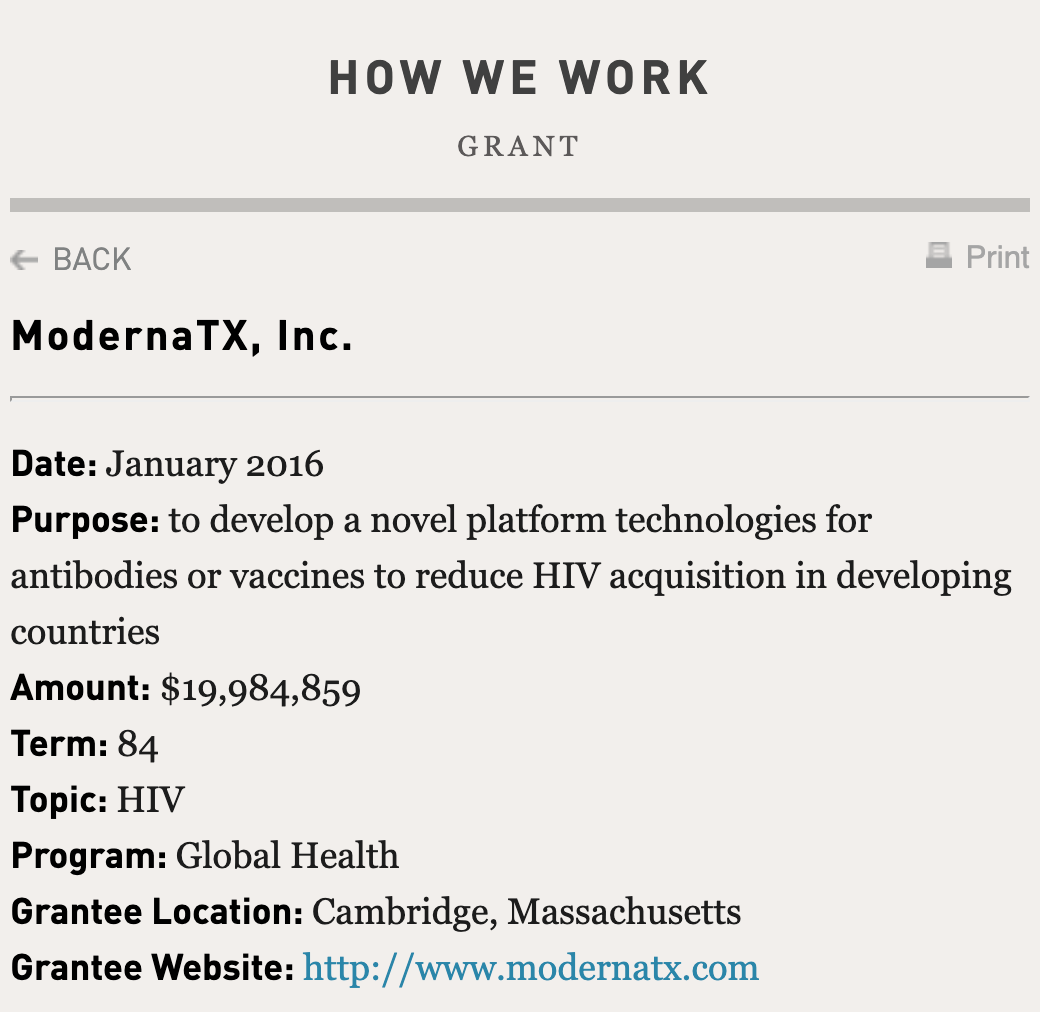

Bill Gates is the one who effectively founded this company, giving them $20 million in 2016.

That’s the kind of thing that would have been a good stock tip.