Eric Striker

Daily Stormer

December 16, 2016

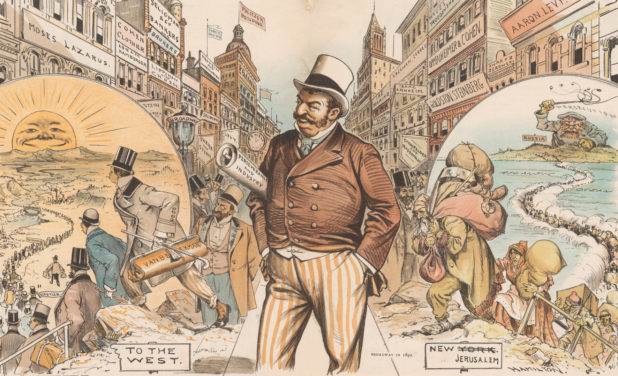

I catch some flack for being an anti-capitalist. The argument my detractors present is that what America has isn’t “real” capitalism, which is more or less the argument campus social-democrats make when they say Stalin’s Russia and Mao’s China weren’t “real” Marxism – an argument the free marketeers routinely and unironically mock. Then they go on to say that replacing the federal reserve (which is a genuine problem, but for somewhat different reasons than libertarians posit) with their favorite pet rock will solve all the inherit contradictions in the system, even though some of the largest hoarders of say, gold reserves, are people like George Soros.

When all is said and done, no nation is closer to pure unadulterated capitalism today than the United States (except when Goldman Sachs needs more money to gamble with, then we have socialism, because of the conundrum of capitalism, where investment banks simply bribe politicians). Thatcherist and conservative ideologues believe the stock market, where no productive work is done, is how national economic health is gaged. According to this metric, we must be living like kings.

CNBC:

In May 2010, when the Dow Jones industrial average was hovering around 10,000 and the markets were coming out of the financial crisis gloom, one financial blogger wrote, “Someone needs to say this: Dow 20K.”

“The Dow will double before it is cut in half. I want to make this proposition right now, with the Dow around 10,000 and many forecasting 5000. … For the moment, let me just say that it is shorter — much shorter — than most people would think,” Jeff Miller, president of NewArc Investments and editor of financial blog A Dash of Insight, wrote at the time.

Six years later, with the 20,000 level mere points away, Miller uses the same analytical tools to forecast further growth.

…

At the time, he was met with skepticism from his blog’s followers. After all, the Dow was nearly 30 percent below its 2007 peak, and the economy was crawling out of a recession. The unemployment rate that month was 9.6 percent, nearly double today’s rate.

“Everyone was so negative” at the time, and knew market participants had a long list of reasons to worry, Miller said. That’s what led him to consider: “What if things got a little better? What if unemployment got down below 8 percent, or Europe stabilized, or the housing market found a bottom?”

But instead, we’re living like kangz.

It’s pretty clear that a big explosion that wipes out the savings of millions of little people is right over the horizon, having Steve Mnuchin as a human shield won’t save Trump from the Jewish financial terrorist attack planned for his presidency.

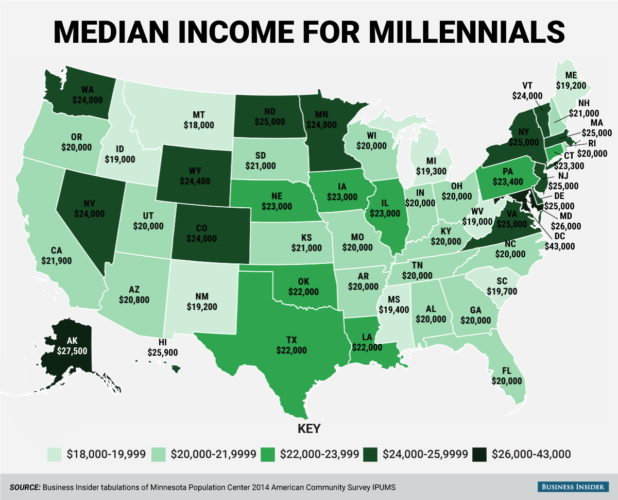

But even then, the stock market rising at a breakneck pace since 2008 has only accompanied a stark decrease in the average Americans wealth and earnings over the last six years. We, the youth, waiting in vain for things to get better so we can finally get married and start to have children, are in the worst shape of all, and my gut feeling is that the numbers are much rosier than what things look like on the ground.

Just half of Americans born in 1984 earned more at age 30 than their parents did at that age, down from 92 percent in 1940, according to research released Thursday by Stanford economist Raj Chetty and five colleagues.

The study found two reasons for the drop: Income inequality has widened, so that even when the economy has grown, fewer Americans have received enough income gains to overtake their parents. And average annual economic growth has slowed since 1980, compared with the 35 years after World War II.

“Reviving the ‘American Dream’ of high rates of mobility will require economic growth that is spread more evenly across the income distribution,” Chetty and his co-authors wrote.Anxieties about status and economic opportunity formed a backdrop to the 2016 election campaign, with many voters concerned that their children wouldn’t fare as well as they had. Conversely, many younger voters worry that they won’t do as well as their parents, largely because of sluggish income growth and higher costs for housing, health care and student debt.

Chetty’s research suggests that those concerns are well-founded. The decline in mobility occurred across all states but was worse in Rust Belt states such as Michigan and Indiana, both of which backed Donald Trump.

State investments like the GI Bill, high capital gains taxes, etc were important hallmarks that led to the creation of the American middle class. Towards the end of the Cold War, figures like Ronald Reagan and Margaret Thatcher embraced neo-liberalism and mass privatization. In retrospect, the British nation got nothing out of Thatcher’s privatization of Telecom, oil, gas, etc. during the 1980’s and yet, when these companies go bankrupt, the government has been forced to increase taxes on every day people in order to pay their debts just to keep the lights on. The tax-payer gets nothing if they profit, but has to foot the bill if they gamble and lose.

But that’s the big picture on the uselessness of market theories on prosperity. In terms of median income, the news gets even worse for those of us under 35.

So wages are going down as fast as prices are going up.

Jews like Trotsky and Kaganovich killed millions of people in Bolshevik Russia, yet it is today underneath the yoke of almost unchallenged global Judeo-capitalism that our race is on the brink of total extinction. In this race to the bottom, the three ounces of gold (((Peter Schiff))) told you to invest all your savings into won’t buoy you when the bill for state-sponsored usury (what capitalism really is in practice) is smacked down on your increasingly Spartan dinner table.