When the earth gets so hot that your ass is sweating all the time, and you have permanent swamp ass, you’re really going to wish you would have…

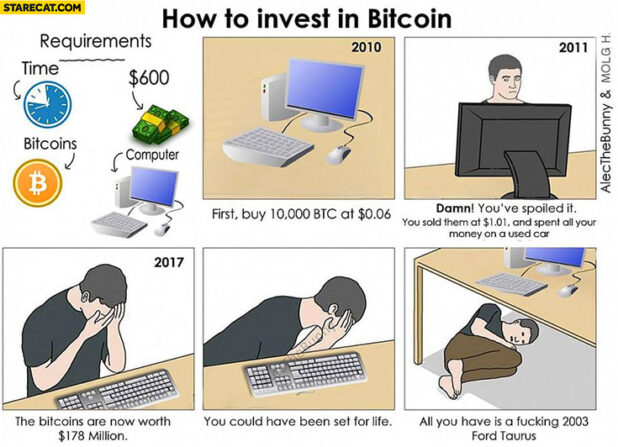

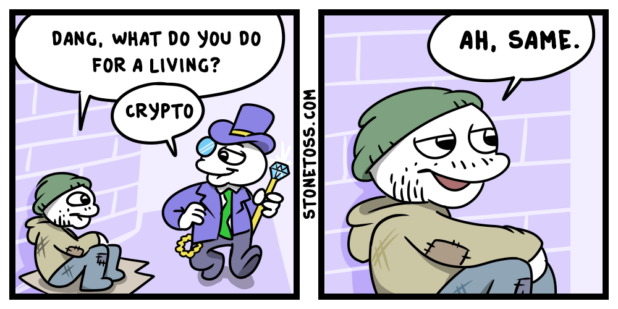

Oh, right, cryptocurrency.

You’re really going to wish something, you goyim pig.

The top U.S. consumer watchdog plans to scrutinize the use of cryptocurrencies for real-time payments and ramp up oversight of Big Tech companies as they expand into the traditional financial sector, its director told Reuters.

The Consumer Financial Protection Bureau (CFPB) also will publish a report this fall on “buy-now, pay later” or BNPL products, and expects to propose a rule to boost consumer finance competition around early next year, Rohit Chopra said in an interview.

Rohit Chopra, owner of a face that inspires trust.

“Is America ready for Big Tech entering financial services? We already have started to see how the industry is entering payments. We’re starting to see how there’s interest in other areas,” said Chopra, citing companies’ branded credit and pre-paid cards. “That raises a lot of questions about really the future of financial services,” especially data privacy, he said.

Cryptocurrencies have come under scrutiny in recent months after the market cratered, toppling some crypto companies.

Big online companies could drive the widespread adoption of cryptocurrencies for real-time payments, which would be a “heavy” focus for the agency, said Chopra, adding that the agency is concerned about the risks of hacks, errors and fraud.

“The regulators all had a wakeup call when Facebook proposed its Libra project, which potentially could be a currency that rapidly scaled across Facebook’s networks,” said Chopra.

That prompted the agency last year to ask Facebook , Amazon.com (AMZN.O), Apple (AAPL.O) and Alphabet’s Google (GOOGL.O), among others, to provide information on how they gather and use consumer payment data, he said.

Facebook ultimately abandoned its Libra project due to regulatory opposition.

A long-time consumer advocate, Chopra was tapped by U.S. President Joe Biden to lead the CFPB last year. Before that, he was a Democratic commissioner at the Federal Trade Commission, where he targeted Big Tech companies over competition concerns.

Monero sure does seem like a cool option, huh dawg?