Steve Sailer

VDARE

January 29, 2015

From the Washington Post :

After the housing collapse derails the American Dream , a cloud of uncertainty hangs over the Boateng family

Story by Kimbriell Kelly

Published on January 26, 2015

DASHED DREAMS : This is the third part in a series looking at the plight of the black middle class, particularly in Maryland ’s Prince George ’s County .

Part 1: Residents of Prince George ’s, the nation’s highest-income majority-black county, lost far more wealth during the financial crisis than families in neighboring, majority-white suburbs.

Part 2: Half of the loans on newly constructed homes in one Prince George ’s County subdivision during the housing boom in 2006 and 2007 wound up in foreclosure.

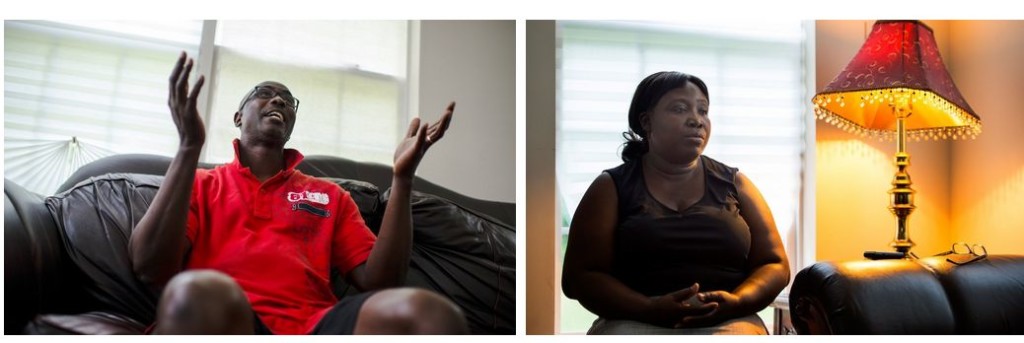

… A decade ago, Comfort and Kofi [Boateng] were at the apex of an astonishing journey they had made from Ghana in 1997, when they had won a visa lottery to come to America . They did not know it at the time, but they were also at the midpoint in their odyssey from American Dream to American Nightmare .

Today, they struggle under nearly $1 million in debt that they will never be able to repay on the 3,292-square-foot, six-bedroom, red-brick Colonial they bought for $617,055 in 2005. The Boatengs have not made a mortgage payment in 2,322 days — more than six years — according to their most recent mortgage statement. Their plight illustrates how some of the people swallowed up by the easy credit era of the previous decade have yet to reemerge years later.

Is plight exactly the right word to describe somebody who has not had to pay to live in a new 3,292 square foot house for the last six years? And who owns a second home?

When they moved into the house in November 2005, Kofi was earning $82,740 as an IT consultant for a government contractor, and Comfort , then 43, was making $30,000 as an administrative assistant. But in the overheated mortgage market of the time, they said everyone told them that they could buy a $600,000 house.

They made a $60,000 down payment and all their mortgage payments for more than 2½ years — through September 2008. But the house was financed with subprime loans, which reset to higher rates after short time periods, creating what are known as “shock payments.” The Boatengs said they could not make their new higher payment, and, in the middle of the 2008 mortgage crisis, they could not refinance.

“I think the hardest part was the beginning,” said Kofi , now 55. “It was when I realized we really lost something. . . . Initially, we were arguing. But I guess it was because we were blaming each other for a mistake we both made.”

They came from a Ghanaian culture where credit is scarce and people built their houses with cash and lived in them for generations. Deeply religious, they found their real estate agent and mortgage broker at their church, Agape Life Ministries in Laurel .

Research has suggested that the subprime bubble looked in part like an Affinity Group Scam . A lot of the worst loans were made to minorities by co-ethnics who had gotten into the mortgage business as part of financial world’s enthusiastic Drive for Diversity .

When their money got tight, they borrowed more and refinanced to take on more debt. Caught up in the mind-set of the time, they said, they thought they would be able to continue to refinance.

Prince George ’s County had the highest foreclosure rate of any county in Maryland , and Fairwood , despite its $173,000 median income, was the fourth-hardest-hit neighborhood in the county. Fifty percent of the loans made there in 2006 and 2007 went bad, according to an analysis by The Washington Post . Nearly one-third of the foreclosures were among African immigrants such as the Boatengs , even though they made up only 5 percent of the county’s black population.

Wow. About 30% of the foreclosures were on immigrants from Africa . (Is that in the overall county or just the Fairwood neighborhood?)

But it’s fascinating that African immigrants had so much worse default rates than African-Americans .

(I wonder if that’s also true in Houston , another destination for African immigrants. Overall, default were less frequent in Houston because home prices are cheap.)

By the way, Hispanics (mostly immigrants, presumably) had worse foreclosure rates in Prince George ’s County than did blacks overall. From a study of foreclosures in Prince George ’s County by Katrin B. Anacker, James H. Carr, and Archana Pradhan :

White: 1.91% (372 foreclosures) Hispanic: 6.42% (3.4X the white rate, 1,091 foreclosures) Black: 3.62% (1.9X the white rate, 4,219 foreclosures)

Back to the Post story:

The Boatengs opened up their financial records and provided The Post with hundreds of pages of bank, credit and mortgage documents for review.

Sidebar : A growing debt

How one family went from no debt to owing more than $1 million. *Debt does not include interest or other fees July 1997 The Boatengs arrived in the United States DEBT : $0

1999 Purchased a used Toyota Corolla for $2,000 CARS : $2,000 DEBT : $2,000

May 2000 Took out a mortgage on a three-bedroom town home in Germantown . CARS : $2,000 MORTGAGE : $128,900 DEBT : $130,900

2000 Purchased a new Nissan Altima for $12,000. CARS : $14,000 MORTGAGE : $128,900 DEBT : $142,900

2003 Comfort began to take out student loans. 2002-2005 Refinanced their Germantown home several times to fund improvements and to pay off some debt, including the cars. MORTGAGE : $128,900 CASHOUTS : $95,000 DEBT : $223,900

July 2004 Refinanced their Germantown home to borrow $60,000 for the down payment on a new house in Fairwood , outside of Bowie . CARS : $14,000 MORTGAGE : $128,900 CASHOUTS : $155,000 DEBT : $283,900

November 2005 Took out two loans to buy the new home in Fairwood . GERMANTOWN MORTGAGE : $128,900 GERMANTOWN CASHOUTS : $155,000 FAIRWOOD MORTGAGES : $554,683 DEBT : $838,583

September 2006 Refinanced to consolidate the two loans on Fairwood home and some debt. GERMANTOWN MORTGAGE : $128,900 GERMANTOWN CASHOUTS : $155,000 NEW FAIRWOOD MORTGAGE : $612,276 DEBT : $896,176

2006 Took out personal loans after their tenant in Germantown failed to pay rent. Comfort obtained two $20,000 business loans. GERMANTOWN MORTGAGE : $128,900 GERMANTOWN CASHOUTS : $155,000 FAIRWOOD MORTGAGE : $612,276 PERSONAL LOANS : $15,000 BUSINESS LOANS : $40,000 DEBT : $951,176

August 2011 Bank valued the home in Fairwood at $378,216. This was $238,839 less than what they paid. 2013 Comfort completed a master’s degree after taking out roughly $60,000 in student loans. GERMANTOWN MORTGAGE : $128,900 GERMANTOWN CASHOUTS : $155,000 FAIRWOOD MORTGAGE : $612,276 PERSONAL LOANS : $15,000 BUSINESS LOANS : $40,000 STUDENT LOANS :$60,000 DEBT : $1,011,176

January 2015 The Boatengs are still living in the Fairwood home. They have not made a mortgage payment in more than six years.

Sources : Post analysis of financial records

Every 90 days since May 31, 2010, they have received a letter threatening to foreclose on their home. They have been able to stay in the house through a confluence of factors: banks wading through a glut of foreclosures, the slow gears of the legal process, bureaucratic negotiations for mortgage modifications and an aversion by lenders to empty homes.

… Seeking better opportunities, they applied online for a lottery administered by the State Department to receive a U.S. permanent resident card.

Everybody knows that a great way to select people is through a random lottery. That’s why Harvard lets in 500 applicants per year at random. Goldman Sachs annually puts all the resumes they receive in a spinning drum and hires the first 200 they grab. Bill Belichick always makes one of his annual NFL draft picks by throwing darts at a list of all the college football players in America .

It was a long shot. Annually, less than 5 percent of the 1 million immigrants granted permanent residency enter the United States through the lottery, according to federal data.

… The Boatengs became citizens in 2003,

Because they love us for our freedoms!

allowing Comfort ’s mother to get a green card and move in, eliminating the $300 weekly child-care costs.

Oh, wait, no, it sounds like they had self-interested reasons. But that must be very rare.

But with three bedrooms and two full bathrooms for six people, they needed more room.

Thanks to a booming housing market, their townhouse was worth $355,000. It was time to buy a bigger home.

For advice on neighborhoods, the couple turned to their 300-member church, where Kofi directed the choir. Most of the congregation is from Ghana or Nigeria . The church members suggested Prince George ’s County .

… Fairwood had drawn other Ghanaians , as well as Nigerians and Cameroonians who were part of a general influx of West African immigrants into the Washington area, particularly into Prince George ’s. The county has the second-highest rate of African immigrants per capita nationwide, behind only Baltimore County , according to recent census estimates.

In 2005, Kofi and Comfort met with one of the home builders in Fairwood , which sits in an unincorporated area of Prince George ’s outside of Bowie , and they decided to build a house for a little more than $600,000.

This was more house than they were expecting to buy, but they believed it would be a good investment. They said they thought it would go up in value, like their Germantown house, and they could use that equity to finance their children’s college educations.

“The purpose of getting the house was to get our kids through college,” Comfort said.

Uh …

Their real estate agent told them they could afford it by refinancing the mortgage on the Germantown house — which they were going to keep — and cashing out the $60,000 in equity. That could serve as the down payment for the Fairwood house. At the time, Kofi ’s credit score was 748, a superior rating that indicated that they were good at managing their debt.

Working through a mortgage broker, they applied for a loan, which they received from Lehman Brothers Bank under Kofi ’s name. They said they were told that, based on their income, they could qualify for an interest-only, adjustable-rate mortgage. They would pay only the interest for the first five years, after which they would be required to make payments on the principal and interest. Such loans are riskier, and borrowers and have been shown to default at higher rates than a traditional 30-year fixed rate mortgage.

The Boatengs ended up borrowing $493,600 from Lehman Brothers , at an initial loan rate of 6.1 percent. In five years, it would reset to at least 8.3 percent. Their payments would start at $3,662 and go up to $4,336.

An 18% increase. In other words, that’s not really the full story of why they’ve gotten six years of free rent in a big new house out of America .

They thought they would be able to refinance to a better rate in the future. In those days, refinancing was easy to get, and the Boatengs went with the tide.

“I don’t think we really understood everything,” Comfort said. “It’s very difficult to deal with everything, especially when you’re dealing with this huge document that you don’t really understand. We didn’t take it too hard that this was going to be a problem. We thought we’d be able to manage it.”

Workers started building the house in June 2005, and the closing was set for October . But in August , Kofi was laid off after his company lost its lucrative government contract with the Army . “The company said, ‘We have no job for you,’ ” Kofi said.

Now, the Boatengs faced a dilemma. Their home was nearly finished, and they had become emotionally attached to it. They were worried they would lose their $20,000 deposit, and they weren’t even sure they could back out of the deal.

“At that time, it’s not like we wanted to back out, too,” Comfort said. “We had already done everything for the house.”

They did not tell the bank that Kofi lost his job.

Details, details, who can keep track of little things like a job loss?

Banks are supposed to verify employment and income prior to approving a loan. Nevertheless, the loan closed, and the Boatengs also received a second loan to complete the financing through their broker’s company, a 30-year fixed-rate mortgage of $61,700 at 8.5 percent. They paid $29,000 in closing costs and put down a total of $73,000 in cash at the closing.

On Nov . 25, 2005, the family moved into their new home in Fairwood . …

Kofi looked for a job and the couple sought a renter for their Germantown home. Their payments on the two houses amounted to $5,550 each month.

“We wanted to sell it,” Comfort said of the townhouse. “But some church members also have rental properties. So they said we shouldn’t, that we should rent it out. And we did it.”

So now they own two houses: the American Double Dream !

In December , they found a tenant, whose rent check would cover the Germantown mortgage. And Kofi was hired by a tech company in Fairfax County , earning $82,000 a year.

But February and March came and went with no rent check. Soon they were in court asking a judge to evict the tenant, a process that takes months. “They couldn’t pay their rent,” Comfort said. “We couldn’t kick them out.”

Kofi went to Bank of America and took out a $5,000 personal loan to cover their mortgages for a month. When the case dragged on, Comfort went to Bank of America and received a personal loan for $10,000.

In subsequent months, with Kofi ’s consent, she took out a $20,000 personal loan from Federal Credit Union in Montgomery County to start a home business selling Mary Kay products. The loan carried a 15 percent interest rate over a 10-year term.

That sounds like a plan!

She didn’t see the loan as a risk but as a way to help the family, and she says she believed that she could earn up to $7,000 a month with Mary Kay . …

She said she quickly earned director status and was given the choice of a leased car, a Pontiac Vibe , or the money in cash, $700 a month. The family decided to take the money.

To grow her Mary Kay business, Comfort said she took out another $20,000 loan from the same credit union, under the same terms, but this time she did not tell Kofi . She was sure she would be successful. But now she was juggling selling cosmetics and recruiting people for Mary Kay with a job search in her own field. She fell behind. Cases of merchandise sat in their home.

In late 2006, the couple decided to refinance their Fairwood mortgage and consolidate their debt, including the personal loans and some auto and student loans. They met with another mortgage broker, also a church member.

They eventually took out a $620,000 refinancing loan from Countrywide Home Loans .

You know, if you read any Sailer post long enough, Angelo Mozilo will show up.

It was also an interest-only subprime loan, carrying a 6.29 percent interest rate and adjusting in two years instead of five. Their payment on the Fairwood house would rise to about $5,230 by November 2008.

As the broker walked them through their credit report, Kofi learned about the second $20,000 loan taken out by Comfort .

… The Boatengs made their last Fairwood mortgage payment on Sept . 18, 2008.

… The Boatengs received their first notice of Bank of America ’s intent to foreclose on their home on May 31, 2010. The mortgage was 606 days past due.

… Two weeks later, on Aug . 31, 2011, Bank of America sent an unsolicited “short sale agreement” to the Boatengs , which would require the couple to sell their home. The bank offered them $3,000 to assist with moving expenses and told them they had to agree to sell by Christmas Day .

The bank valued the house at $378,216.

… The couple said someone — they do not remember who — referred them to the Brooklyn -based Litvin Law Firm , which specializes in foreclosure defense. The Boatengs said they started paying Litvin $750 monthly. This continued for two years, for a total of $15,000, they said. But then they got a call from an ex-Litvin employee who said the Boatengs should stop paying because the firm was not licensed to conduct business in Maryland .

“After Litvin , we realized we don’t have anybody,” Comfort said.

On Nov . 18, the Litvin Law Firm settled a complaint with the Maryland attorney general’s office that it had charged hundreds of consumers large fees but often did not help them avoid foreclosure or modify their loans.

… During much of this time, Comfort was unemployed or not working full time. In October 2010, she lost her administrative assistant job at Family Health International in Virginia . Her unemployment benefits ran out after eight months.

Beginning in 2003, she had been a part-time student in health-care administration at University of Maryland University College , with a goal of getting a bachelor’s degree and eventually a master’s. To help pay for the schooling, she took out student loans. She had earned two bachelor’s degrees, one in health-care administration in 2009 and another in organizational management in 2010, but by the time she completed her master’s in health-care administration in 2013, the debt had reached $90,000, including interest.

She said she went to school and took out the loans because she thought that was the American way to get ahead and earn more for her family.

“In my country, there’s a proverb that says we use fish to catch fish,” she said. “So before you can catch the fish, you have to use the fish. Before I can get to the money or level where I want to be, it takes money.”

With $257,776 owed on the Germantown house, $969,037 owed on the Fairwood house, $55,000 in personal loans and the student loan debt, the couple who had never owned a credit card before moving to the United States now owe more than $1.3 million.

They currently earn about $100,000 a year.

The couple are also working with Housing Initiative Partnership , a HUD -certified housing counseling agency, for help in getting a loan modification. Their housing counselor, Lee Oliver , said their downfall began with the idea of buying a second home for more than $600,000. They were stunned they could own something like that, she said. “Then they just took a leap of faith,” she said. “Where I’m from, these houses were only for white people.”

Comfort’s mother died last January . Comfort had been working part time at a temporary agency in the home-health-care field but is now looking for full-time work.

“At a point, I was so frustrated that recently I said, ‘Why do I have to keep staying in America then? Why don’t I go back to my country and look for a job there?’ ” Comfort said.

That would be self-deporting and that’s the most evil concept ever. So, please continue to envibrate us with your diversity.

Daily Stormer The Most Censored Publication in History

Daily Stormer The Most Censored Publication in History