Zero Hedge

January 16, 2014

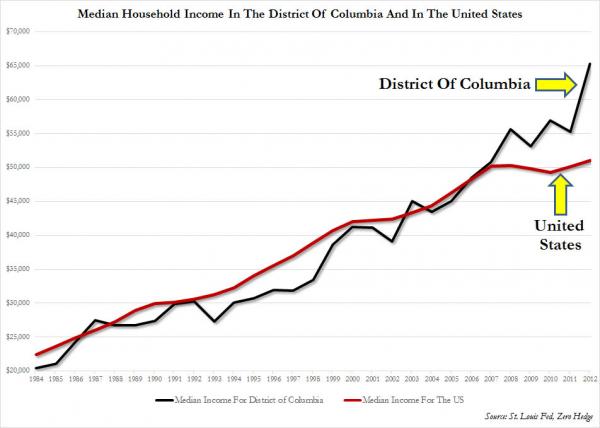

A month ago, we showed a chart of median household income in the US versus that just in the District of Columbia. The punchline wrote itself: “what’s bad for America is good for Washington, D.C.”

Today we got official verification that Bernanke’s wealth transfer in addition to benefitting the richest 1%, primarily those dealing with financial assets, also led to a material increase in the wealth of one particular subgroup of the US population: its politicians.

Today we got official verification that Bernanke’s wealth transfer in addition to benefitting the richest 1%, primarily those dealing with financial assets, also led to a material increase in the wealth of one particular subgroup of the US population: its politicians.

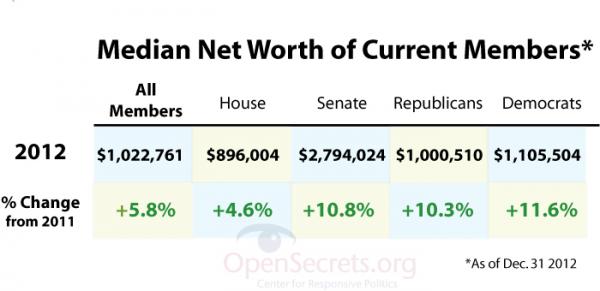

According to the OpenSecrets blog which conveniently tracks the wealth of America’s proud recipients of lobbying dollars, aka Congress, for the first time ever the majority of America’s lawmakers are worth more than $1 million.

Specifically, of 534 current members of Congress, at least 268 had an average net worth of $1 million or more in 2012, according to disclosures filed last year by all members of Congress and candidates. The median net worth for the 530 current lawmakers who were in Congress as of the May filing deadline was $1,008,767 — an increase from last year when it was $966,000. In addition, at least one of the members elected since then, Rep. Katherine Clark (D-Mass.), is a millionaire, according to forms she filed as a candidate. (There is currently one vacancy in Congress.)

Last year only 257 members, or about 48 percent of lawmakers, had a median net worth of at least $1 million.

Because who better to debate the class divide raging across the US thanks to the Federal Reserve’s $4+ trillion balance sheet than a room full of millionaires. On the other hand, perhaps it means they will be less bribable by “donations” and other lobbying funding…

… Yeah, we LOLed at that one too.

OpenSecrets was about as cynical as us: “Members of Congress have long been far wealthier than the typical American, but the fact that now a majority of members — albeit just a hair over 50 percent — are millionaires represents a watershed moment at a time when lawmakers are debating issues like unemployment benefits, food stamps and the minimum wage, which affect people with far fewer resources, as well as considering an overhaul of the tax code.”

“Despite the fact that polls show how dissatisfied Americans are with Congress overall, there’s been no change in our appetite to elect affluent politicians to represent our concerns in Washington, said Sheila Krumholz, executive director of the Center. “Of course, it’s undeniable that in our electoral system, candidates need access to wealth to run financially viable campaigns, and the most successful fundraisers are politicians who swim in those circles to begin with.”

Perhaps one could argue that a country drowning in poverty needs politicians who actually know the troubles that afflict the majority of the population first hand. Actually, according to folklore that is the Democrat party. So it may come as a surprise to some that the median net worth of the average Democrat at $1.1 million (an increase of 11.6% from 2011) is higher than that of any given Republican at just over $1 million, an increase of 10.3% from the prior year.

OpenSecrets breaks down the numbers further:

OpenSecrets breaks down the numbers further:

Congressional Democrats had a median net worth of $1.04 million, while congressional Republicans had a median net worth of almost exactly $1 million. In both cases, the figures are up from last year, when the numbers were $990,000 and $907,000, respectively.

The median net worth for all House members was $896,000 — that’s up from $856,000 in 2011 — with House Democrats (median net worth: $929,000) holding an edge over House Republicans (median net worth: $884,000). The median net worth for both House Republicans and Democrats was higher than in 2011.

Similarly, the median net worth for all senators increased to $2.7 million from $2.5 million, but in that body it was the Republicans who were better-off. Senate Democrats reported a median net worth of $1.7 million (a decline from 2011’s $2.4 million), compared to Senate Republicans, at $2.9 million (an increase from $2.5 million).

Senate Democrats were the only group reporting a drop in their median net worth from the prior year — a decline that is at least partly because of the loss of two extremely well-off Senate Democrats from the list: now-Secretary of State John Kerry, who had been the wealthiest senator with a 2011 average net worth of $248 million, and Sen. Frank Lautenberg (D-N.J.) who had an average net worth of $87.5 million before his death last year.

As we all know, some millionaires are richer than other millionaires. So who took the honors this year?

The richest member of Congress was, once again, Rep. Darrell Issa (R-Calif.) chairman of the House Oversight Committee. Issa, who made his fortune in the car alarm business, had an average net worth of $464 million in 2012. Issa had ruled the roost as the wealthiest lawmaker for several years but was bumped from that perch last year by Rep. Michael McCaul (R-Texas).

In our analysis last year, we estimated that McCaul’s 2011 average net worth was $500.6 million — a dramatic increase for him from the year before. McCaul’s affluence is primarily due to the holdings of his wife, Linda, the daughter of Clear Channel Communications Chairman Lowry Mays. McCaul took a dramatic tumble from the list’s pinnacle, reporting an average net worth of $143.1 million in 2012.

Shed no tears for McCaul, though: His drop wasn’t due to any great financial misfortune, but reflects changes in reporting rules. Beginning with reports covering calendar year 2012, high-value assets, income and liabilities belonging to the spouses of House members may be reported as being worth simply “$1 million or more.” Previously, the forms required somewhat more specific valuations. So, for example, on his 2011 disclosure McCaul reported that his wife owned a 10.1 percent interest in LLM Family Investments that was worth “more than $50 million.” Now, he reports that his wife’s share of the fund has increased to 12.2 percent, but he can list it as a “spousal asset over $1,000,000,” though it’s likely worth much more.

This methodological change (to a system the Senate already uses) also appeared to affect Rep. Chellie Pingree (D-Maine). On her disclosure form covering 2010, she reported having an average net worth of $750,000. Then in 2011 she married hedge fund manager Donald Sussman, which increased her average net worth for that year to $85.8 million. Her report for 2012 shows a dramatic decline, to $42.4 million, because of the new reporting rules.

The least wealthy member of Congress in 2012, at least on paper, was Rep. David Valadao (R-Calif.) — a slot he occupied the previous year as well. Valdao reported an average net worth of negative $12.1 million in 2012. That’s actually a big improvement from 2011, when his average net worth was negative $19 million. According to Valdao’s disclosure forms and our interviews with his staff last year, his debt is the result of loans for his family dairy farm.

The second-poorest member of Congress continued to be Rep. Alcee Hastings (D-Fla.), who for decades has owed millions of dollars for legal bills incurred in the 1980s, when he was charged with accepting a bribe while sitting as a federal judge. As we noted last year, Hastings was acquitted, but later impeached and removed by the Senate before running for Congress in 1992. His level of debt has not changed since 2005.

Although more members of Congress are millionaires than ever before, and the median net worth for all lawmakers is higher than ever, their total net worth — the value of all their assets minus liabilities — fell from $4.2 billion in 2011 to $3.9 billion in 2012. Again, that could be at least partly due to the change in the House reporting requirements for spousal assets and liabilities.

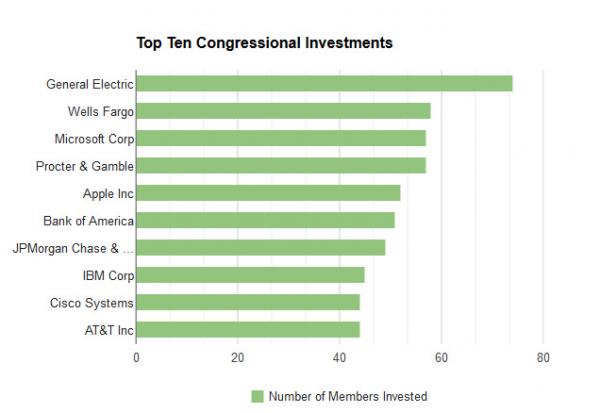

Finally there is a question of which financial assets America’s millionaire legislators mostly own. The answer should surprise nobody, and will probably also explain the perverted and very symbiotic relationship between the US financial system and the governing class.

General Electric continued to be the most popular investment for current members of Congress. In 2011, there were 71 lawmakers who reported owning shares in the company; in 2012, there were 74. The second most popular holding was the bank Wells Fargo, in which 58 members owned shares (up from 40 in 2011). Financial firms were well-represented in the 10 most popular investments: Bank of America came in sixth (51 members) and JPMorgan Chase was seventh (49 members). Both companies had more congressional investors than in 2011 (11 more for Bank of America and 10 more for JPMorgan Chase.)

Of course, the public can surely expect Congress to pass legislation that would imperil their financial investments. Surely.

Of course, the public can surely expect Congress to pass legislation that would imperil their financial investments. Surely.

And finally, why reflating the housing bubble is on top of the agenda for not only Bernanke, but Congress as well:

Overall, though, real estate was the most popular investment for members of Congress. Their investments in real estate in 2012 were valued at between $442.2 million and $1.4 billion. The next most popular industry to invest in was securities and investment, with congressional investments being worth between $64.5 million and $229.6 million.

In conclusion: Congratulations to America’s millionaire politicians. May they enjoy it in health while it lasts. The wealth that is… and the health.