The New Observer

March 31, 2016

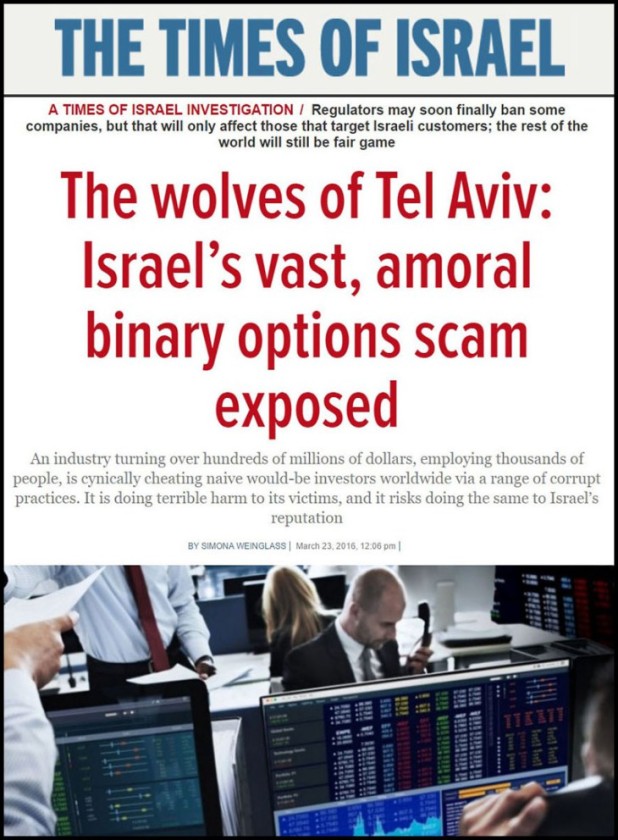

“The wolves of Tel Aviv” is the headline on the Times of Israel—an article published by the Jerusalem-based newspaper which openly admits that Israel is the center of the world’s “binary options” fraud scam—a practice so illegal that the US has outlawed it.

The Israeli binary options “industry” specifically targets non-Jews in Europe, Africa, and the Middle East, brings in over a billion dollars, and employs thousands of Jews cheating “naive would-be investors via a range of corrupt practices.”

Ironically, the title of the Times of Israel article—“The wolves of Tel Aviv” is taken from the autobiographical book, The Wolf of Wall Street, written by the Jew Jordan Belfort.

In that book, Belfort told of his fraud rampage through the New York financial section for which he was finally arrested and sentenced to four years in prison.

Jordan’s New York fraud escapade involved so many Jews that the Jewish Journal, in an article published in December 31, 2013, called it “‘The Wolf’ and the Jewish Problem” after a Hollywood movie was made which glamorized Belfort’s crimes.

The binary scam in Israel works on the same basis that Belfort’s fraud operated: high pressure telephone calls to non-Jews all over the world to persuade them to “invest” in a financial product called “binary options.”

The victims are encouraged to make a deposit—actually to transfer money to the Jewish company—and then use that money to make “trades” in online currency.

This in effect means that the “clients” have to try and assess whether a currency or commodity would go up or down on international markets within a certain, short period of time.

If they predict correctly, they win money, between 30 and 80 percent of the sum they have put down. If they are wrong, they forfeit all the money they put on that “trade”—to the Jewish company.

While this sounds reasonable at first—especially if presented by a fast-talking glib salesman, the reality is vastly different, as the Times of Israel openly admits.

Quoting an Australian Jew, Dan Guralnek, who got cold feet about being involved in the vast scam, the newspaper revealed the truth behind this multinational swindle:

He [Guralnek] heard that jobs in an industry called binary options paid twice what he was earning, plus commission. “As soon as I started looking for a job, I was getting calls from binary options companies every day,” he recalls. “They dominate the job advertisement space.”

Nor did Guralnek have any difficulty landing a job. On the day Guralnek stepped into the lavish offices of his new employer in the seaside town of Herzliya Pituah, he knew he had arrived. “There was free coffee, free food,” says Guralnek. “My salary was 7,500 shekels ($1,900) per month, plus commission.”

The Times of Israel reveals that Guralnek was placed in a call center with about fifty others, all of them “new [Jewish] immigrants to Israel” who were fluent in a variety of languages.

His job, he told the newspaper was to call people around the world and persuade them to “invest” in binary options.

The Times of Israel then reveals how the “trading” process works: having made their first financial transfer to the Jewish company, customers log in to an online trading platform, as directed by the company’s salespeople, and place money on a prediction that the price of a currency or commodity will go up or down on international markets in, say, the next five minutes.

If the customer predicts correctly, he makes a profit of a certain percentage and the company loses money. If the customer is wrong, he loses all the money he placed on the trade, and the company keeps it. Professional options traders consulted by the Times of Israel said that even a financial genius cannot predict with any confidence what, say, the price of gold will do in the next five minutes; rather than an investment, the transaction is really nothing more than a gamble.

Guralnek soon saw that the more trades a client made, the closer they came to losing the entirety of their initial deposit. He then went on to reveal how the “company knows that the whole operation is a scam.”

He was told to present the “binary option” as an “investment” and himself as a “broker,” even though he knew that the victims would lose all their money.

“The client isn’t actually buying anything. What he’s buying is a promise from our company that we will pay him. It’s gambling and we’re a bookie,” he says now.

Guralnek was given a week-long sales course in which he was “taught enough financial knowledge to sound good to a customer who knew less than him. He was also instructed in high-pressure sales tactics,” the Times of Israel said.

“They taught us how to make people uncomfortable, how to answer objections, how to keep them on the phone.”

During this sales course, Guralnek said, the trainer told the course attendees to “leave our conscience at the door.”

He went on to reveal the secrecy which the “binary options” companies in Israel operate: he was never told the surnames of his managers, and the workers were all prohibited from speaking Hebrew or bringing cellphones into the call center.

The company’s CEO was a mystery, and the Arab speaking staff were instructed to “sell binary options in places like Saudi Arabia while other countries, like Israel, the United States, and Iran were off-limits.”

Every salesperson is given a fake name and biography, and the call center uses Voice over Internet Protocol (VoIP) technology, which displays a local phone number to customers anywhere in the world. The company’s website listed an address in Cyprus.

Guralnek was told to tell “clients” he had years of experience in the market, and that he had studied at Oxford and worked for the Bank of Scotland.

He was also told to present himself as a broker who made a commission on the trades and to emphasize how much money the customer could make while downplaying the risk.

Guralnek also revealed what happened when suspicious clients tried to quit.

“We would say, ‘You want to withdraw? OK. We need to verify your identity before we can release the funds. You need to send us a photocopy of your utility bill, your driver’s license, your passport, your credit card’” — requirements, needless to say, that had not been mentioned when the client put money in.

In addition, while the customer was gathering and submitting this paperwork, a “retention” agent would call them and go through their trades, purportedly figuring out what went wrong and convincing them to continue trading. “We could delay that withdrawal for a long time,” Guralnek admitted.

If a “client” was really persistent, then, Guralnek says, very often the company would stop taking their calls, or send them an email saying ‘we suspect you of fraud’ and freeze all their funds. Because the customer didn’t know the real name or location of their salesperson, “they had nowhere to turn to get their money back,” he explained.

A view of the Tel Aviv skyline. The tallest building, Ramat Gan’s Moshe Aviv Tower, houses many binary options companies.

According to the Times of Israel, conservative estimates put the number of people employed in this industry at several thousand, mostly in Tel Aviv and its suburbs like Herzliya and Ramat Gan, while annual revenue could be anywhere from hundreds of millions to over a billion US dollars.

The industry is, the Times of Israel says, “blatantly corrupt.” At some companies, the article continues, the “house is bent” and a “variety of ruses are used.”

The potential payout for a correct prediction is complex, opaque and calculated to minimize the company’s loss. If an asset is behaving in a predictable way — say, the price of copper starts to climb following an earthquake in Chile — the company will pull that asset from the online platform.

At some binary options firms, the online platform is manipulated to provide false results that ensure the customer loses.

The newspaper says that there are probably several hundred “binary options” companies operational in Israel.

According to the IVC Research Center, a company that provides information about Israel’s technology sector, “it’s difficult to gauge the actual size of the online financial trading industry in Israel,” in part because the industry is “low-key” and its “Israel nexus is often understated.”

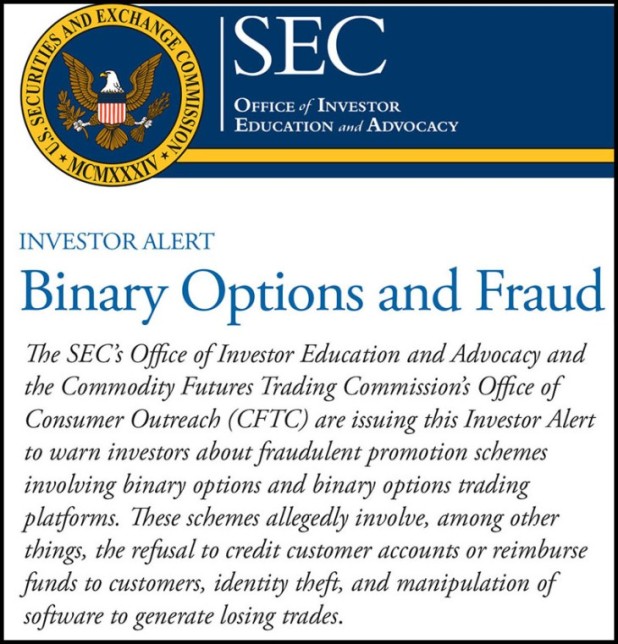

In 2013, the United States outlawed the marketing of binary options to its citizens, except on a handful of regulated exchanges. The US government’s Commodity Futures Trading Commission (CFTC) has issued a “fraud advisory” about “binary options,” saying that the advisory was sent out:

“. . . to warn investors about fraudulent promotion schemes involving binary options and binary options trading platforms. These schemes allegedly involve, among other things, the refusal to credit customer accounts or reimburse funds to customers, identity theft, and manipulation of software to generate losing trades.”

Another Jewish recent immigrant to Israel, “Sam C.,” also spoke to the Times of Israel, revealing that the scams are exclusively aimed at non-Jews outside Israel:

Most of the customers of Sam’s company were from the United States, even though it is against US law for companies to sell binary options to US citizens in this way.

Additional clients were from Africa, Qatar, and Saudi Arabia.

Many had clicked on an ad hawking ways to “earn money from home” or watched a video that claimed to reveal secret investment strategies.

“The majority seemed to be… the stereotypical dumb person,” recalls Sam. “You don’t even realize that people like this exist outside of movies. They actually believe that they’re going to become a millionaire just by doing this. And it’s almost sad.”

Asked about his managers, Sam said they were young Israelis who appeared to think it was cool to rip people off.

Another Jew, Graham P., told the Times of Israel that the binary options websites have “back doors” through which the companies manipulate a “trade” at the last minute if a customer or group of customers appears to be winning too much.

”For some crazy reason it’s legal in Europe. Individual European nations are letting binary options fly. While countries like the United States smelled the bullshit a long time ago and made it illegal.”

Graham said that on a gut level, he would like to see the industry shut down, but he is worried.

“There’s so much money pouring into the city; it’s literally an industry here — I’m including forex too. It’s probably paying for the subway system we’re installing. Can you imagine thousands of people in Tel Aviv out of work?”

While the Times of Israel must be commended for its honesty in exposing this worldwide Jewish scam as being run from Israel, its motivation for doing so is less moral that it would seem.

As the paper makes clear, its intent in lifting the lid on this huge Jewish scam being perpetrated against non-Jews is not motivated by moral outrage, but rather only on what damage this might be doing to what it calls “Israel’s reputation.”

A follow-up editorial in the Times of Israel, dated March 28, 2016, titled “Binary options: An Israeli scam that has to be stopped,” went on to state this motivation clearly:

The binary options scam unhappily shows the dark side of Israel’s ‘start-up nation’ capacity for enterprise. Rather than a force for good, in this case, Israeli innovation is being used to enable theft.

For example, Israelis’ entirely legitimate expertise in Search Engine Optimization (SEO) is here being utilized in the sophisticated manipulation of Google’s search engine, whereby the companies perpetrating the fraud turn up high on Google searches, the better to attract new clients.

Unfortunately, Israeli fraudsters have already tarnished the country’s reputation abroad with scams such as the aggressive sale of radically overpriced Dead Sea products in shopping mall kiosks, as well as a complex rip-off involving locksmiths in parts of the United States which also relies on manipulation of Google and other search engines.

The scale of the binary options fraud, however, dwarfs such scams, both in its cynicism and in the colossal sums of money involved. The longer it goes on, the greater the damage to Israel’s good name.

In its first article, the Times of Israel also quoted a November 2014 letter sent by Ariel Marom, one of the employees of these companies, to the Finance and the Ethics committees of the Israeli parliament, (the Knesset):

I am calling on the regulator in charge of banking services and the Knesset Finance Committee to immediately take action to stop the wave of plundering, theft, fraud, money laundering, and crime on an international scale that is managed and operated in Israel that is hurting thousands of customers around the world.

When this information becomes public knowledge through investigative reports by the media, which is bound to happen sooner or later, Israel’s status in the world will be damaged and it will unleash a wave of hatred toward the Jewish people and Israel, causing tremendous damage.

The Knesset never even reacted to Marom’s letter.

It comes as no surprise that the practice of selling “binary options” inside Israel—that is, to Jews—is forbidden by Israeli law.

However, as the Times of Israel admits, while Jews in Israel are protected from this scam, “the rest of the world will still be fair game.”

Daily Stormer The Most Censored Publication in History

Daily Stormer The Most Censored Publication in History