Edmund Connelly

Occidental Observer

December 29, 2014

“Indeed, from the very beginnings of the industry until the present, it is impossible to ignore the influence of Jews on the movie business or to overlook the importance of a Jewish consciousness in American films.”

—Lester D. Friedman“The Jewish involvement in motion pictures is more than a success story; it is the basis of the disproportionate influence that Jews have had in shaping American popular culture.”

—Steven Silbiger“The way Steven Spielberg sees the world has become the way the world is communicated back to us every day.”

—Stephen Schiff(See Edmund Connelly, “Understanding Hollywood, Part I: Hollywood’s Jewish Identity”

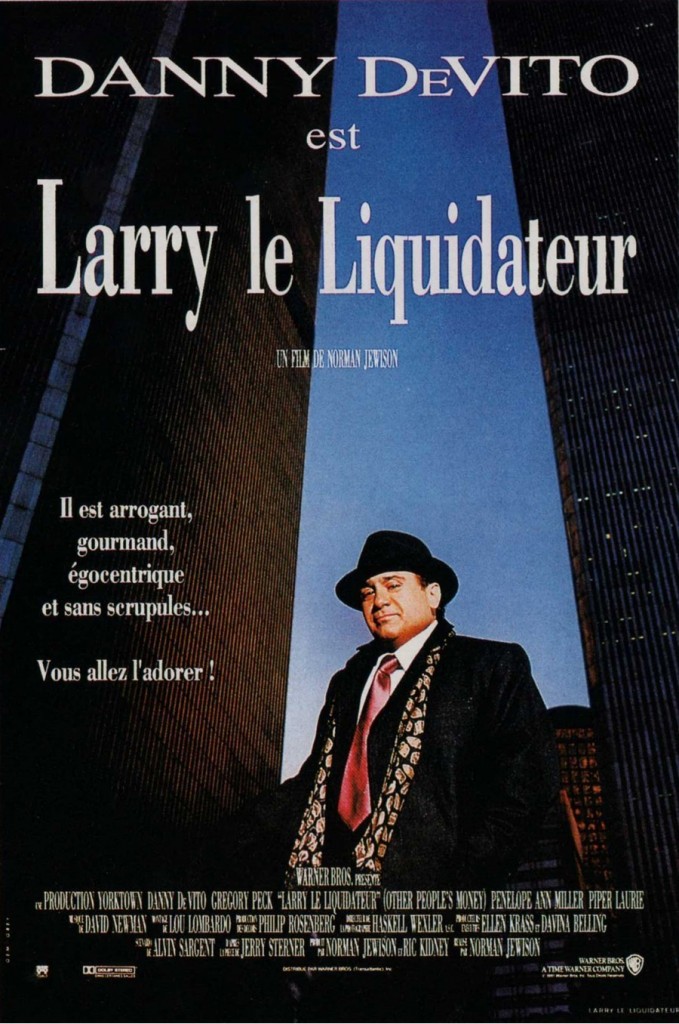

First, the argument: Hollywood, which is and always has been controlled by Jews, uses the medium of film to mask the vast power Jews have over the finances of America — and much of the rest of the world. In particular, Hollywood makes every effort to whitewash the reality of massive Jewish malfeasance in matters financial. This has been one of my major themes on TOO. See, for example, here, here, here, and here. As you will read, I have documented this pattern and will supplement it with an extensive treatment of the 1991 film Other People’s Money, which gave us a command performance by the diminutive Danny DeVito.

The timing of this film is critical, for it came after a decade of highly publicized Wall Street deals, many of questionable legality or blatant illegality. When we consider the sad spectacle of these scandals of the 1980s, what we find is that there is no doubt about the identity of the vast majority of culprits — at least for those with eyes to see it.

Two writers who had both the eyes to see it and the talent to write about it intelligently were Connie Bruck — who is Jewish — and James B. Stewart — who is not. (Intriguingly, the obituary of Stewart’s mother notes that her son James’ “spouse” is one Benjamin Weil, who is Jewish.)

Bruck wrote The Predators’ Ball: The Inside Story of Drexel Burnham and the Rise of the Junk Bond Traders. The book has more than enough information to convince the average reader that Jewish financial mischief is rife — and has a massively negative effect on the greater non-Jewish world.

Stewart’s book is even better, beginning with its title, Den of Thieves. In the book, Stewart chronicles the misdeeds of Ivan Boesky, Martin Siegel, Dennis Levine (who wrote his own book Inside Out: The Dennis Levine Story), and most of all, Michael Milken, the mastermind behind it all. Simply by describing all the Jews involved, Stewart makes it clear that it was a cabal of Jews that pillaged and destroyed some of the most well-known corporations in America at the time by inventing and peddling “junk bonds” as an advance in capitalism which enabled hostile takeovers of corporations while typically saddling them with huge debt while enriching the arbitragers.

Others add similar views. For instance, scholar Albert Lindemann, in his masterpiece Esau’s Tears: Modern Anti-Semitism and the Rise of the Jews, was careful to include tales of tainted money in his story as well, writing that it had become clear that “the stock market scandals of the mid-to-late 1980s in the United States saw an overwhelming preponderance of Jews — at least ninety percent was a widely accepted figure.”

Reflecting the legitimacy of white collar crime in the wider Jewish community in the contemporary world, Milken is a pillar of the Jewish community in Los Angeles and a major donor to Jewish causes. Indeed, this is part of a pattern: Ivan Boesky donated $20 million to the library at the Jewish Theological Seminary. And the notorious Marc Rich has donated millions of dollars to a wide range of Jewish causes, including Birthright Israel, a program designed to increase Jewish identification among young Jews. The list of people supporting Rich’s pardon by Bill Clinton was “a virtual Who’s Who of Israeli society and Jewish philanthropy.” A rabbi concerned about the ethics of these practices notes, “it is a rare Jewish organization that thinks carefully about the source of a donor’s money. . . . The dangerous thing is not that people make moral mistakes, but that we don’t talk about it.”

Stewart covered Wall Street in the 1980s as a writer for The Wall Street Journal; he sums up the background of Den of Thieves in the Prologue. “Financial crime was commonplace on Wall Street in the eighties. . . . During the crime wave, the ownership of entire corporations changed hands, often forcibly, at a clip never before witnessed. Household names — Carnation, Beatrice, General Foods, Diamond Shamrock — vanished in takeovers that spawned criminal activity and violations of the securities laws.”

Other People’s Money

The above description perfectly matches the storyline of Other People’s Money. Significantly, the film deceives viewers in the same ways last year’s The Wolf of Wall Street does. As I wrote about the Hollywood version of The Wolf of Wall Street, “No wonder the Wiki article on the film never mentions ‘Jew’ or ‘Jewish.’ Jewish identity is invisible.” The exact same thing can be said of Other People’s Money. Jews do not exist in this 1991 movie, and it is no casual oversight that this is the case, as I will show below.

Watch the opening of the film, with DeVito’s stark “I Love Money” soliloquy. Now which ethnic stereotype does that fit? (Hint: think of a Shakespeare play whose title starts with “Sh” and rhymes with “High Rock.)

Here is the plot of the film. DeVito stars as the Wall Street takeover artist Lawrence Garfield, and his eye has been caught by the rise in the share price of a small Rhode Island wire and cable foundry. After careful analysis, he decides to take control of the company and reap a windfall by liquidating the core business and selling off the equipment and land.

Opposing him is the current chairman of the board, Andrew Jorgenson, son of the firm’s founder. Six-foot-three actor Gregory Peck, appearing in his last major role, plays this chairman, “Jorgy” as he is affectionately known. Jorgy’s WASP identity and that of his family, the president of his company, and, presumably, the bulk of the workforce, coupled with the small-town New England setting of the foundry, allows a good contrast between the identities of those from New York City and its metropolitan setting. The contrast, however, never begins to hint at Jewish identity, though.

The genesis of Other People’s Money is important, for it began as a play of the same name by Bronx-born Jerry Sterner. The original play’s protagonist, “a Jewish corporate takeover artist, was named Larry Garfinkle, not Garfield.” And stage actor Kevin Conway played him as a very Jewish character, to the point that “some critics and audiences … found Conway’s performance to be larger-than-life — uncomfortably so. Some reviewers called Conway’s Garfinkle a Wall Street Jackie Mason — a performance more akin to stand-up comedy than straight theater, one that emphasized the character’s ethnicity and loaded Sterner’s play with potentially anti-Semitic ‘Merchant of Venice’ overtones.”

Sterner worried about this, as he related in an interview with the New York Times, saying “I did not want the play to become controversial about what it is not about. It’s not about Garfinkle’s being Jewish, it’s about his doing good or not.” Because of his discomfort with Conway’s portrayal of the explicitly Jewish Garfinkle, Sterner added a “cautionary postscript” to the play’s published text: “The character of Garfinkle can be played in many ways. The one way he should not be played is overly, coarsely, ‘ethnic.’ ”

Even with this controversy, when the play moved to Hollywood, the script retained the name Larry Garfinkle, but it was crossed out and changed to “Garfield.” Director Normal Jewison (by most sources, not Jewish) admitted that he changed it. “It’s not important that Larry Garfinkle is Jewish. Boone Pickens isn’t Jewish. Jimmy Goldsmith is, as are nine out of the 12 top corporate raiders in America, but there are three others that aren’t. What does it matter, anyway? This isn’t about religion.”

Actor DeVito was equally unconcerned about this issue, saying “I’m obviously not Jewish, but my wife (actress Rhea Perlman) is and so I guess my kids are Jewish. Look, we’re not laying into any big ethnic thing here. You don’t look at me and think Norwegian. I’m Italian. But to play this guy as a Jewish arbitrager, don’t you think that would be like playing a gangster movie with only Italians? It’s kind of an ethnic slur.”

This same sort of whitewashing was in evidence of earlier Wall Street takeover artist film, Wall Street (1987), starring the half-Jewish Michael Douglas and Charlie Sheen. Director Oliver Stone (also half-Jewish) misled viewers, as Wiki admits: “Weiser wrote the first draft, initially called Greed, with Stone writing another draft. Originally, the lead character was a young Jewish broker named Freddie Goldsmith, but Stone changed it to Bud Fox to avoid the stereotype that Wall Street was controlled by Jews.”

In Wall Street as well, the famous character of Gordon Gekko is simply not Jewish. Four years later, DeVito’s “Larry the Liquidator” Garfield is not Jewish. In 2013, DiCaprio’s Jordan Belfort is not Jewish. There is a pattern.

Henry Makow puts this pattern in perspective when expounding on why DiCaprio does not play a Jewish character in The Wolf of Wall Street. ”Just as many Jews changed their names, Hollywood has skewed ethnicity. For example, in Chicago, the Jewish lawyer played by Richard Gere is the Irish “Billy Flynn”. In Shattered Glass, the Jewish homosexual plagiarist is portrayed as a straight gentile, better to convince the goyim that gay-Jewish behavior is their behavior. In Mean Streets, Martin Scorsese makes the street criminals white, although in real life they are black.”

So there we are: the 1991 film Other People’s Money, is not about Jews. Actually it is, but the reality is deliberately hidden; a veil is draped over viewers’ eyes. This deceit is apparently not commonly noted because Internet searches bring up relatively few links to Jewish identity and the films mentioned above. A powerful minority is constructing a narrative, and woe to he who deconstructs it.

Still, Other People’s Money does offer other insights if one is already decently informed about Jewish identity and behavior. The movie can easily be seen as a parable about the fall of WASP — or more generally, non-Jewish power in America and its replacement by that wielded by a hostile new elite.

If you watch Other People’s Money knowing that the original play had a Jewish protagonist and knowing that the Wall Street takeover kings of the 80s were overwhelmingly Jewish, it then becomes a clear story about actual American history over the last half century. This is beautifully captured in the final scenes where Jorgy and Garfield battle for the votes of shareholders, which TOO readers can now watch thanks to the wonders of the Internet and YouTube. Here is the text of WASP Jorgenson’s appeal:

Jorgenson: Well, it’s good to see so many familiar faces, so many old friends. Some of ya I haven’t seen in years. Well, thank you for coming. Now, Bill Coles, our able President, in the annual report has told you of our year, of what we accomplished, of the need for further improvements, our business goals for next year and the years beyond.

I’d like to talk to you about something else. I wanna share with you some of my thoughts concerning the vote that you’re gonna make in the company that you own. This proud company, which has survived the death of its founder, numerous recessions, one major depression, and two world wars, is in imminent danger of self-destructing — on this day, in the town of its birth.

There is the instrument of our destruction. I want you to look at him in all of his glory, Larry “The Liquidator,” the entrepreneur of post-industrial America, playing God with other people’s money.

The Robber Barons of old at least left something tangible in their wake — a coal mine, a railroad, banks. This man leaves nothing. He creates nothing. He builds nothing. He runs nothing. And in his wake lies nothing but a blizzard of paper to cover the pain. Oh, if he said, “I know how to run your business better than you,” that would be something worth talking about. But he’s not saying that. He’s saying, “I’m going to kill you because at this particular moment in time, you’re worth more dead than alive.”

Well, maybe that’s true, but it is also true that one day this industry will turn. One day when the yen is weaker, the dollar is stronger, or, when we finally begin to rebuild our roads, our bridges, the infrastructure of our country, demand will skyrocket. And when those things happen, we will still be here, stronger because of our ordeal, stronger because we have survived. And the price of our stock will make his offer pale by comparison.

God save us if we vote to take his paltry few dollars and run. God save this country if that is truly the wave of the future. We will then have become a nation that makes nothing but hamburgers, creates nothing but lawyers, and sells nothing but tax shelters. And if we are at that point in this country, where we kill something because at the moment it’s worth more dead than alive — well, take a look around. Look at your neighbor. Look at your neighbor. You won’t kill him, will you? No. It’s called murder and it’s illegal.

Well, this too is murder — on a mass scale. Only on Wall Street, they call it “maximizing share-holder value” and they call it “legal.” And they substitute dollar bills where a conscience should be. Dammit! A business is worth more than the price of its stock. It’s the place where we earn our living, where we meet our friends, dream our dreams. It is, in every sense, the very fabric that binds our society together.

So let us now, at this meeting, say to every Garfield in the land, “Here, we build things. We don’t destroy them. Here, we care about more than the price of our stock! Here, we care about people.

Larry Garfield is then afforded his own response, and clearly the entire debate is modeled on Gordon Gekko’s famous “Greed is Good” speech from Wall Street. (See that further below). Garfield takes the microphone (watch here) and intones:

Garfield: Amen. And amen. And amen. You have to forgive me. I’m not familiar with the local custom. Where I come from, you always say “Amen” after yonow the surest way to go broke? Keep getting an increasing share of a shrinking market. Down the tubes. Slow but sure.

You know, at one time there must’ve been dozens of companies makin’ buggy whips. And I’ll bet the last company around was the one that made the best goddamn buggy whip you ever saw. Now how would you have liked to have been a stockholder in that company? You invested in a business and this business is dead. Let’s have the intelligence, let’s have the decency to sign the death certificate, collect the insurance, and invest in something with a future.

“Ah, but we can’t,” goes the prayer. “We can’t because we have responsibility, a responsibility to our employees, to our community. What will happen to them?” I got two words for that: Who cares? Care about them? Why? They didn’t care about you. They sucked you dry. You have no responsibility to them. For the last ten years this company bled your money. Did this community ever say, “We know times are tough. We’ll lower taxes, reduce water and sewer.” Check it out: You’re paying twice what you did ten years ago. And our devoted employees, who have taken no increases for the past three years, are still making twice what they made ten years ago; and our stock — one-sixth what it was ten years ago.

Who cares? I’ll tell ya: Me. I’m not your best friend. I’m your only friend. I don’t make anything? I’m makin’ you money. And lest we forget, that’s the only reason any of you became stockholders in the first place. You wanna make money! You don’t care if they manufacture wire and cable, fried chicken, or grow tangerines! You wanna make money! I’m the only friend you’ve got. I’m makin’ you money.

Take the money. Invest it somewhere else. Maybe, maybe you’ll get lucky and it’ll be used productively. And if it is, you’ll create new jobs and provide a service for the economy and, God forbid, even make a few bucks for yourselves. And if anybody asks, tell ‘em ya gave at the plant.

And by the way, it pleases me that I am called “Larry the Liquidator.” You know why, fellow stockholders? Because at my funeral, you’ll leave with a smile on your face and a few bucks in your pocket. Now that’s a funeral worth having!

Now compare Garfield’s “Love of Money” speech to Gordon Gekko’s:

Gekko: Well, I appreciate the opportunity you’re giving me, Mr. Cromwell, as the single largest shareholder in Teldar Paper, to speak. Well, ladies and gentlemen, we’re not here to indulge in fantasy, but in political and economic reality. America, America has become a second-rate power. Its trade deficit and its fiscal deficit are at nightmare proportions.

Now, in the days of the free market, when our country was a top industrial power, there was accountability to the stockholder. The Carnegies, the Mellons, the men that built this great industrial empire, made sure of it because it was their money at stake. Today, management has no stake in the company!

All together, these men sitting up here [Teldar management] own less than 3 percent of the company. And where does Mr. Cromwell put his million-dollar salary? Not in Teldar stock; he owns less than 1 percent. You own the company. That’s right — you, the stockholder. And you are all being royally screwed over by these, these bureaucrats, with their steak lunches, their hunting and fishing trips, their corporate jets and golden parachutes

Cromwell: This is an outrage! You’re out of line, Gekko!

Gekko: Teldar Paper, Mr. Cromwell, Teldar Paper has 33 different vice presidents, each earning over 200 thousand dollars a year. Now, I have spent the last two months analyzing what all these guys do, and I still can’t figure it out. One thing I do know is that our paper company lost 110 million dollars last year, and I’ll bet that half of that was spent in all the paperwork going back and forth between all these vice presidents.

The new law of evolution in corporate America seems to be survival of the unfittest. Well, in my book you either do it right or you get eliminated.

In the last seven deals that I’ve been involved with, there were 2.5 million stockholders who have made a pretax profit of 12 billion dollars. Thank you.

I am not a destroyer of companies. I am a liberator of them!

The point is, ladies and gentleman, that greed — for lack of a better word — is good.

Greed is right.

Greed works.

Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.

Greed, in all of its forms — greed for life, for money, for love, knowledge — has marked the upward surge of mankind.

And greed — you mark my words — will not only save Teldar Paper, but that other malfunctioning corporation called the USA.

Thank you very much.

Yes, these competing views of society offer a parable, and they show us how White dispossession is being accomplished, in part through high finance. To be sure, Jorgy’s defense of tradition America now strikes us as quaint, as the financial dislocations that had occurred by 1991 were trivial when compared to today. Offshoring of manufacturing jobs really took off well after Other People’s Money came out, and the whole economic edifice came close to collapse in 2008. (Jewish involvement in that debacle, from Federal Reserve Chairman Alan Greenspan on down is a story of its own.)

It’s also important to note that both movies present the arbitraged companies as deserving their fate. But the implication that the companies targeted by the arbitragers were making obsolete products and doomed to extinction anyway—the theme of Larry the Liquidator’s soliloquy— is misleading at best. In fact, around half of American corporations received hostile takeover bids in the 1980s. Making obsolete products had nothing to do with the buyout wave of the 1980s.

And while it is likely true that the takeovers led to increased efficiency (Gordon Gekko’s line) as management was forced to pay off the enormous debt resulting from the takeovers, around one-third of the buyouts occurring in the late 1980s resulted in bankruptcy because of the debt load (see previous link). There’s no doubt that, whatever long term effects resulting from this era in Wall St., it was motivated by greed and several of the main actors served prison terms for their roles in the takeovers.

Jorgenson and his family are the old America, captured nicely in a touching recreation of Norman Rockwell’s Thanksgiving Day feast. But the sad reality is that Jorgenson loses his plant, the workers are thrown out of work, and the man who loves money has won. Oh, sure, there is a scene tacked on to the end of the film where a Japanese conglomerate wants to buy the plant to produce steel-embedded cloth for automobile airbags, but that does little to erase the impression that White America has become a very different place, a place led by those like Larry Garfield.

As I wrote last month, we can find treatment of this theme in Kevin MacDonald’s essay “The Dispossessed Elite,” where he reviews Andrew Fraser’s The WASP Question and agrees that “the Puritan-descended WASP elite that dominated the board rooms and the elite universities have lost their religious faith, and what is left of it is little more than a mild version of cultural Marxism; they have generally succumbed to the destructive forces of the new cultural dispensation.” (See also here.)

MacDonald also agrees with Fraser that America is worse off under its new elite, with the country now “an increasingly corrupt corporate plutocracy in which Ivy League Jews are heavily over-represented. . . . Worse still, Jewish elites harbor a deep-seated animus toward the Christian faith professed by most Americans.” It’s one thing for the WASP elite to be displaced. It’s quite another when the elite replacing them is hostile to the people and culture they now rule over.

This heavily Jewish elite has been highly creative in making money, a theme familiar to even our ancestors. To a shocking degree, it is now the kind of world we are forced to live in, where money trumps all other values. For those interested in further reading about this critical subject, I suggest Culture Wars editor E. Michael Jones’ “Barren Metal: A History of Capitalism as the Conflict between Labor and Usury.” Since Hollywood is not going to give us even a scrap of reality when it comes to the issue of Jews and money, we’ll have to get our information elsewhere.