Roy Batty

Daily Stormer

May 2, 2018

The countries that are pushing hardest for a “cashless” society are, of course, the Scandinavians. Why? Well, because the government wants to do two things:

Deny dissidents the ability to participate in the economy

And

Charge negative interest rates.

You gotta read between the lines:

RT:

Fewer than 10 percent of Norwegians are still using paper currency or coins, which could completely disappear in a decade, according to the local authorities.

Jon Nicolaisen, the deputy governor of Norway’s central bank, has said Norwegian society has become cashless, and that this is very much a present reality rather than a future dream.

“By approximation, I would argue that the present is cashless,” he said at the City Week conference at London’s Guildhall in a discussion on the future of paper currency, chaired by the Bank of England’s chief cashier.

“According to our latest numbers, we have less than 3 percent of broad money in cash. Less than 10 percent of the number of transactions, including buying coffees, are in cash,” he said.

Norway’s chief banker added that the phenomenon has nothing to do with the Bank of Norway’s policy, it’s just the wish of the people. “We have no wish to eliminate cash. It is the public itself that chooses other means of payment,” he said.

Cashlessness is on the rise globally, as more and more people are abandoning paper money. Scandinavia and neighboring Finland have been the leaders in this area.

Sweden is the ‘most cashless nation’, with barely 1 percent of the value of all payments made using coins or notes. For example, the country has banned cash on buses for concerns over drivers’ safety.

“In the not-too-distant future, Sweden may become a society in which cash is no longer generally accepted,” the Swedish central bank has said.

However, not everyone is pleased in Scandinavia about the cashless system. In Sweden, there is a movement called Kontantupproret (the cash insurgency), which demands that people should decide what form of money to use, not just banks and businesses.

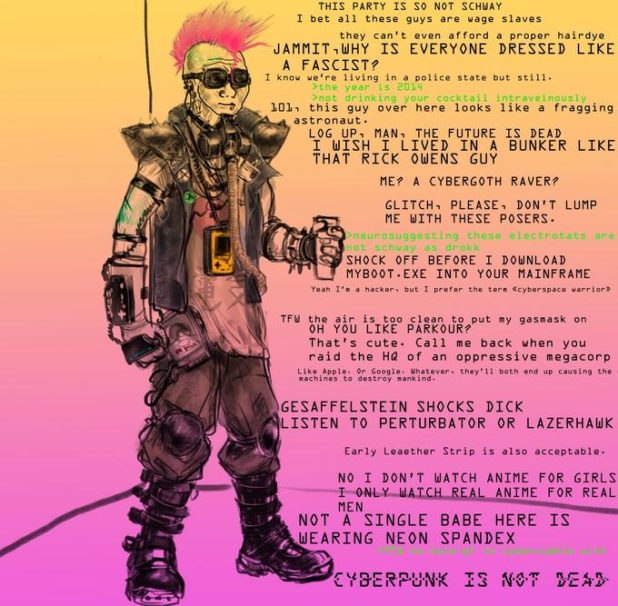

Lol, that last part is pretty cyberpunk. I approve.

So the first goal is pretty straight-forward. There is a push to do away with cash because this way the government can keep tabs on where you travel, where you keep your money and then sell that information to corporations trying to gather data on you to create a consumer profile.

Only, in the near future, banks will just stop doing business with political dissidents. They’ll stop giving out credit cards. And at that point, political dissidents won’t be able to buy anything at all or hold down a job and effectively be starved out of society.

Or the government will just block/take away certain people’s credit cards, ability to pay for regular stuff in society.

An easy, no-fuss way to deter dissent. Very passive-aggressive. Back-handed and indirect. Totalitarianism Swedish-style.

The second benefit of a cashless society is also interesting.

Negative interest rates work like this – well, first imagine positive interest rates.

Basically, you put money in the bank and you collect a percentage on your money because what the bank is doing is they’re playing around with your money, investing it, speculating, whatever – and they’re paying you for the privilege of monkeying around with your money.

If there are high-interest rates, people are encouraged to save. Because the more they have in the bank, and the longer they have it, the more money they make.

If interest rates become lower, people are incentivized to take their money out and spend it. The logic is simple – why bother keeping it in the bank, sitting on it like an egg when you’re making nothing in interest. Better to just go out and buy that TV now.

Now, negative interest rates would have a similar effect.

In other words, the longer you kept your money in the bank, the more money you would lose.

Why would a bank do this? Well, if the government wanted to stimulate the economy, get people to save less and consume more to increase GDP, they could use this tool to encourage people to go out and buy shit quick because their money is losing its value every day, so it’s better to get that TV now than tomorrow when it’ll cost 5% more or something.

So this is an incredibly useful tool for any GloboHomoTechnoCorpo state.

And stupid consumerist normies will lap it up. They’ll try to sell it as a convenience. Or an anti-robbery measure. We are literally probably only a decade away before people become too lazy to swipe their credit cards and enter their pins, so they’ll have dermal chips or barcodes imprinted on them.

And if I know normies at all, you’ll be seen as weird for not hopping on the barcode fad.

So, yeah, I’m joining the Cashless Insurgency for sure. It sounds pretty cyberpunk and rad, so I’m totally down.