Andrew Anglin

Daily Stormer

December 27, 2018

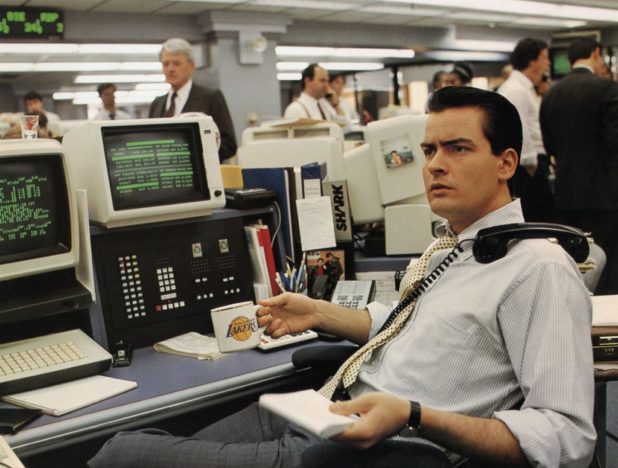

People ask me like “Anglin, when are you going to write about the latest [THING RELATED TO STOCK MARKET]?”

And I’m just like “lol, no. I don’t know anything about that and it is fake and gay.”

CNBC:

Stocks posted their best day in nearly a decade on Wednesday, with the Dow Jones Industrial Average notching its largest one-day point gain in history. Rallies in retail and energy shares led the gains, as Wall Street recovered the steep losses suffered in the previous session.

The 30-stock Dow closed 1,086.25 points higher, or 4.98 percent, at 22,878.45. Wednesday’s gain also marked the biggest upside move on a percentage basis since March 23, 2009, when it rose 5.8 percentage points.

The S&P 500 also catapulted 4.96 percent — its best day since March 2009 — to 2,467.70 as the consumer discretionary, energy and tech sectors all climbed more than 6 percent. The Nasdaq Composite also had its best day since March 23, 2009, surging 5.84 percent to 6,554.36.

Wednesday also marked the biggest post-Christmas rally for U.S. stocks ever.

Retailers were among the best performers on Wednesday, with the SPDR S&P Retail ETF (XRT) jumping 4.7 percent. Shares of Wayfair, Kohl’s and Dollar General all rose more than 7 percent. Data released by Mastercard SpendingPulse showed retailers were having their best holiday season in six years. Amazon’s stock also jumped 9.45 percent, snapping a four-day losing streak, after the company said it sold a record number of items this holiday season.

Based on the state of the world, it should be going up or down, continually, if there was any kind of logic to it. We are sort of sailing in a relatively clearcut direction, overall. Instead, I keep hearing about “WORST DAY EVER” and “BEST DAY EVER.”

This is not a serious business proposal. It is just a gambling ring.

I understand how in theory you could look at certain companies and try to determine their trajectory. That is still gambling, but it’s at least informed gambling, like betting on sports. But when you add in the fact that random “stock events” just affect the entire market as a whole, often affecting stocks that are totally unrelated to other stocks, you’ve lowered it to the level of a slot machine.

Single day jumps and dips can be in the double-digit percentages for some of the biggest companies in the world.

My advice is, if you’re going to play the stock market, make sure to get a job with the CIA first.

Daily Stormer The Most Censored Publication in History

Daily Stormer The Most Censored Publication in History