Andrew Anglin

Daily Stormer

March 30, 2014

The biggest issue I have with the whole impending doom situation is that American leaders are treating Russia like it is some Third-World Muslim territory of cave-dwelling illiterate camel jockeys, when in reality they could easily flex their muscles and destroy us, if they so desired.

The fact that Obongo and Jewn Kerry refuse to take the situation seriously on any level bothers me a lot more than the fact that they are trying to bully Russia in the first place. Though my sympathies are with Russia, of course, it would all feel quite a bit less terrible if they appeared to have some understanding of the situation.

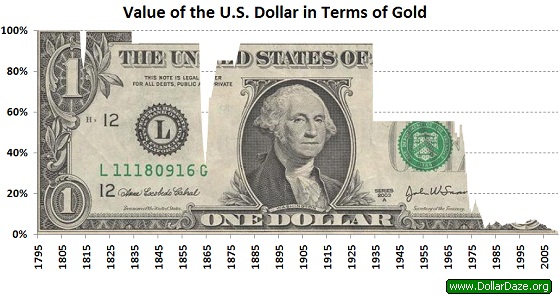

For instance, they seem completely oblivious of the fact that Russia could, at the drop of a hat, collapse the US economy.

Russia can collapse the United States, prominent US trader Jim Sinclair believes. The economist, famous for his forecasts, explains that the strength of the dollar is based on the US agreement with Saudi Arabia that all contracts for fuel deliveries be in the US dollars. Now, Moscow can collapse the petrodollar in one moment. The slapping of sanctions on Russia is tantamount to a shot in the foot. The expert explains that the only true value in the world today is the petrodollar. But Russia can collapse it by demanding Euros or Yuan for its oil.

What’s more, the US may lose its influence on Europe for good, if Russia starts selling its fuels for anything but the dollars. Angela Merkel would be only happy, for Germany, as well as other European countries would then have no need for currency markets. The rate of the Euro would then grow, while the cost of oil and gas would go down. But the United States should be ready for an abrupt increase in gasoline prices, for hyperinflation amid a poor business climate and a crash of the Dow Jones industrial average, Sinclair predicts.

But does Moscow need this kind of scenario? One of the tough measures that the West said it would resort to should be cutting Russia off the SWIFT interbank payment system. But should this happen, the sanctions would hit hardest their own authors, says a Stock Market Chair Professor at the Higher School of Economics in Moscow, Alexander Abramov, and elaborates.

“Technically, it is pretty easy to cut Russia off the SWIFT system by blocking Russian banks’ IP addresses. But SWIFT is one of the main systems that banks use for international payments. Hardly anyone in the US or Europe would like to resort to this kind of move, since banks are interrelated. If Russian banks are unable to use the system, they will fail to make timely payments to their western counter parties, which will prove quite a shock to the financial system. Now, this is by far more real a threat than using Euros to pay for oil. I think the financial world, which has just started emerging from the crisis, can’t be happy about these kinds of shocks”.

I would also argue that Russia, if properly provoked, could pretty well conquer the entirety of Europe without breaking a sweat. The only thing the West has on its side is a bunch of futuristic technologies, but they can’t even beat the cave Muslims of Afghanistan with that.

In war, the bottom line is the fortitude of your soldiers. Russia has that and the West doesn’t.

Daily Stormer The Most Censored Publication in History

Daily Stormer The Most Censored Publication in History