Previously on Bitmania: There is No Reason to Attack Elon Over Bitcoin – Just Wait and See What He’s Doing!

Crypto analytics company Elliptic has published an extract of its upcoming guide to sanctions compliance in cryptoassets, detailing how Iran uses Bitcoin to “evade sanctions.”

Elliptic claims to be pro-crypto, and they’re just trying to help the community by “preventing financial crime.”

However, every currency can be used in financial crime, and that has nothing to do with anything. Bringing it up at all is just a form of sabotage. No one is asking “what can we do to stop crypto-mining in Iran” other than the US government, which has already declared outright hostility to crypto.

This stupid discussion about Iran is part of a larger operation to portray Bitcoin as the criminals’ currency and harmful to the environment.

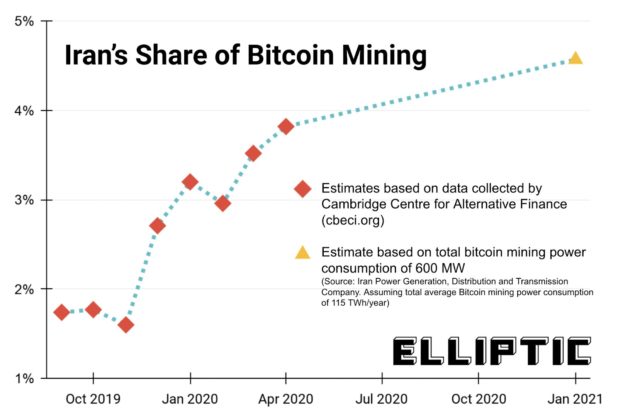

Elliptic estimates that 4.5% of all Bitcoin mining takes place in Iran, allowing the country to circumvent trade embargoes and earn hundreds of millions of dollars in cryptoassets that can be used to purchase imports and bypass sanctions. This has implications for financial institutions engaging in cryptoasset transactions – who should ensure they have appropriate controls in place to avoid sanctions violations.

The US imposes an almost total economic embargo on Iran, including a ban on all Iranian imports and sanctions on Iranian financial institutions. Oil exports have plummeted 70% over the past decade, leaving the country in a deep recession with soaring unemployment and periods of civil unrest.

In the face of these sanctions, Iran has turned to an unlikely solution – Bitcoin mining.

Bitcoin and other cryptoasset networks run on electricity, and quite a lot of it. Bitcoin miners run power-hungry computers, which process new transactions and add them to the blockchain. In return, the miners are rewarded with bitcoins – both from transaction fees as well as the minting of new bitcoins. The mining process effectively converts energy into cryptocurrency.

…

The Iranian state is therefore effectively selling its energy reserves on the global markets, using the Bitcoin mining process to bypass trade embargoes. Iran-based miners are paid directly in Bitcoin, which can then be used to pay for imports – allowing sanctions on payments through Iranian financial institutions to be circumvented.

This has become all but an official policy, with a think tank attached to the Iranian president’s office recently publishing a report highlighting the use of cryptoassets to avoid sanctions.

Who cares?

Doesn’t Iran also use US dollars?

Should we stop printing those to fight against Iranians making a living?

Many of those making the Bitcoin transactions and paying the fees to Iran-based miners will be located in the United States – the very country spearheading the sanctions. As the US government considers whether to lift some sanctions on Iran in exchange for a return to a nuclear deal, it will need to consider the role that Bitcoin mining plays in enabling Iran to monetise its natural resources and access financial services such as payments.

In the meantime, financial institutions should consider the sanctions risk they are exposed to due to Iranian Bitcoin mining – particularly those that are beginning to offer cryptoasset services. If 4.5% of Bitcoin mining is based in Iran, then there is a 4.5% chance that any Bitcoin transaction will involve the sender paying a transaction fee to a Bitcoin miner in Iran. Financial institutions should also be on the lookout for crypto deposits originating from Iranian miners that are seeking to cash-out their earnings.

Solutions for Sanctions Risks

However as we discuss in more detail our new sanctions guide, solutions to these challenges exist and are already used by financial institutions engaging in cryptoasset activity.

For example, blockchain analytics solutions such as those provided by Elliptic can be used by regulated financial institutions to detect and block cryptoasset deposits from Iran-based entities including miners. Techniques can also be employed to ensure that transaction fees are not paid to miners in high risk jurisdictions.

That is not true.

The whole “decentralized” nature of Bitcoin means that it is democratic in terms of who mines it.

Maybe there is some insane plot which could be used to stop Iran from mining, but I don’t know how it would work.

Anyway – no one is really clear on what exactly Iran did wrong in the first place, other than get rid of their old president, who was max awesome.

What is clear is that there is a concerted effort by Jewish bankers to demonize Bitcoin, because it threatens the entire Jewish usury scheme.

The “mining uses too much electricity” thing is especially insane – how much electricity do bank buildings use, just lighting them, heating them, cooling them? How much energy do jets use, flying all these bankers all over the world to engage in their criminal schemes?

How much energy is used in the commute of every employee from every bank, going to work every day?

Cryptocurrency could, using current technology, just completely eliminate the entire banking system. There are already smart contract systems that allow individuals to loan crypto to other individuals at rates much lower than those offered by banks. There would literally be no more need for banking, at all. This would also completely destroy this scheme to inflate the price of everything – in particular real estate – through the debt scheme which is only backed up by usury.

But the entire army of soypersons (persons of soy?) will come out and denounce you for planning to change the weather so their fat asses will become so sweaty it’s like Niagara Falls in the ass-section of their baggy jeans.

Jews have to control every aspect of your life forever or everyone gets sweaty – it’s SCIENCE!

Expect Mr. Freedom Sean Hannity to come out and denounce Bitcoin as a threat to the freedom of the Jews in the next 12 seconds.

He’s Mr. Freedom – but only when it comes to your right to turn yourself into a bloated beast by eating processed food, and Jeff Bezos’ right to make billions by locking you in your house and stealing your wealth.

Freedom to be liberated from the Jew banking system?

Not so much on Sean’s agenda.

Note from Anglin: We’re Still Rocking and Blocking

Regardless: even after an extensive boycott, divestment and sanctions movement against Bitcoin, it is still holding strong.

We could all do with a little help from Elon, but he did assure us his hands are made of diamonds.

Tesla has 💎 🙌

— Elon Musk (@elonmusk) May 19, 2021

Honestly, after the Chinese claim that they’re banning it, I feel really good. Firstly, if China does ban it, it helps the market, because they’re a net exporter of Bitcoin. Secondly, China has said this like at least 17 times before, and what ends up happening is the price drops, a bunch of Chinese buy in and then China decides not to ban it.

China has nothing to gain by banning it. They are making money, and it doesn’t threaten their financial system in the way it threatens the Jewish financial system, because the Chinese financial system is built to promote business rather than rob the population. China would do fine if Bitcoin became the world currency, whereas the entire Western establishment would collapse, unable to run their sickening usury scheme upon which all their other diabolical plots are based.

I think things will continue to happen, and it might go as low as $30,000, or even lower. But the future looks good. At least until the US Government bans it outright.