A statement regarding recent events.

Tripwire Official Site: https://t.co/Vgyx0jMLBb pic.twitter.com/rmKp105EIg

— Tripwire Interactive (@TripwireInt) September 7, 2021

If there was a plan to save Deutsche Bank, it would have been implemented by now.

There is no plan to save the bank. The plan was for that gay retard Agent of Brandon (pipe bombing assistant) Schultz to go out and do Baghdad Bob.

Maybe the Germans are still filled with enough childlike naïveté that this will keep normal people from doing a run on the bank, but they can’t keep the traders from doing credit default swaps – whatever that is.

Deutsche Bank’s stock struggled on Friday after an increase in pricing for its credit default swaps, adding to anxiety surrounding the global banking system.

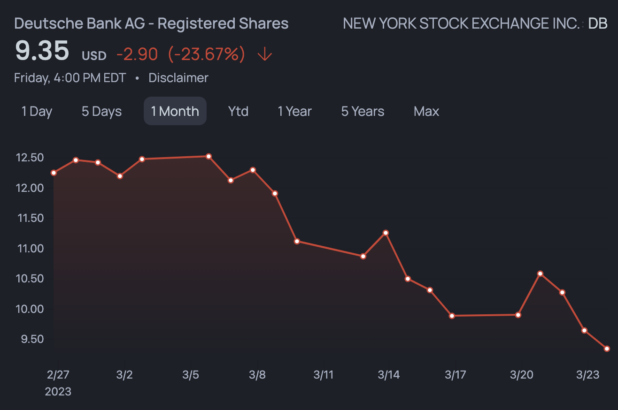

Shares of Deutsche Bank dropped by 11% on Friday. It was the third day in a row that the German-based megabank had its value decline, with shares losing more than a fifth of their total value so far this month alone.

It’s more than a fifth.

It’s almost a fourth.

Credit default swaps, known as CDS, allow an investor to swap their credit risk with another investor, creating a form of insurance against default. CDSs typically go up as investors see the entity in question as being riskier.

I still don’t understand.

On Friday, Deutsche Bank announced it will redeem a tier 2 subordinated bond ahead of schedule, which can be seen as a way to give investors confidence about the firm’s balance sheet, although because shares are slumping, investors might still have doubts.

“It is a clear case of the market selling first and asking questions later,” Paul de la Baume, senior market strategist at FlowBank SA, told Bloomberg. “There continues to be enormous concern that the banking crisis could merge into a heavier risk-off event in markets.”

Germany’s DAX, which is a basket of 40 German blue-chip companies, was down by 1.75% on Friday following the turmoil and uncertainty in the banking sector.

Friday marks two weeks from the day that United States-based Silicon Valley Bank collapsed. SVB’s sudden failure has triggered a series of related problems in not only the U.S. banking system but also the world.

Switzerland-based megabank Credit Suisse began tanking earlier this month after the chairman of Saudi National Bank, the bank’s biggest shareholder, announced it would not be increasing its stake, given regulatory constraints.

UBS then agreed to buy out fellow Swiss competitor Credit Suisse, with support from Swiss authorities, amid the latter’s turmoil following SVB’s collapse. Under the terms of the proposed purchase, UBS agreed to purchase Credit Suisse for just over $3 billion, just a fraction of the firm’s estimated value.

On Friday, the Dow Jones Industrial Average dropped more than 200 points on the worries in Europe.

The Federal Reserve on Thursday released an update on emergency borrowing. It showed borrowing from the Bank Term Funding Program that was created at the outset of the crisis has quickly ballooned to $53.7 billion, up from $34.6 billion the week before.

Borrowing is also high from the Fed’s discount window, which is its permanent program for lending to banks that might be having liquidity problems. While discount window borrowing shrunk from last week and is now at about $110 billion, that figure is still right around the highest level it was at during the 2008 financial crisis

Lawmakers have raised the notion of increasing the cap on the Federal Deposit Insurance Corporation’s $250,000 cap or even having the federal government temporarily insure all deposits in order to return stability to the banking system.

I’m joking about not knowing what a credit default swap is. But this “we can just insure everything” bit really doesn’t make sense to me.

Insofar as I can speculate as to what that means, they think that saying “we’ll insure everything” would keep people from doing a run on the bank and therefore require them to insure much less. However, if people actually wanted the money, they would just have to print it, which would mean they would probably be triggering hyperinflation.

It’s complicated and there is some question as to whether hyperinflation could even happen in the United States, given that a key feature of hyperinflation is huge portions of the population rapidly trading out the faltering currency for another currency. In the US, there is no other currency.

Or is there…?

Anyway, I’m not gonna tell you to pull all your money and buy Bitcoin. That would be irresponsible of me, because no one knows what Bitcoin is going to do.

I will say, however… I’m not seeing a scenario in which Bitcoin doesn’t do extremely well over the next year, and it’s possible that it could shoot up to some outrageous amount. So at the very least, it makes sense to have some. You own a lot of things that could potentially lose a lot of value – the riskiest of which being dollars themselves. So it’s unlikely at this point that taking on some Bitcoin would change your risk profile for the worse.

Preparing for liftoff pic.twitter.com/GsqVYT5cdV

— Andrew Anglin (@WorldWarWang) March 26, 2023

I think the apocalypse predictions are probably wrong, as they usually are. The problem is, while we might have a soft landing in a “collapse” situation – due to infinity insurance or capital controls or firing Jerome Powell and lowering the interest rates or whatever else the Jew wizards come up with – the crisis is permanent.

There is literally no possible way for the US economy to come back from a major downturn, so we’re looking at a permanent drop in the quality of life for the majority of people in the cities, a permanent situation of little to no opportunity, living on welfare, subsidized housing, crime, drugs, etc.

It’s going to look like the collapse of the USSR, except with diversity. But we won’t have the hope that Putin provided for Russia a decade after the collapse. Unless, a decade after the collapse, a charismatic strongman takes control.

Nick Fuentes https://t.co/ufJjVldplc pic.twitter.com/qNSqlf3LM3

— Tvwlttrßüçkš (@TvwlttrUcks) March 24, 2023