The ride is over. Big time.

This is only a local fed branch, but someone said it, so now it is out there in the public.

RT:

The Federal Reserve Bank’s Dallas branch has warned of a “brewing US housing bubble,” saying that prices have surged beyond levels justified by market fundamentals, creating risk of a market collapse.

“There is growing concern that US house prices are again becoming unhinged from fundamentals,” Fed economists said in a research report posted earlier this week. “Our evidence points to abnormal US housing market behavior for the first time since the boom of the early 2000s,” they added.

That boom preceded a market bust, triggering the 2007-2009 global financial crisis. However, if the current bubble bursts, it wouldn’t likely cause as much economic fallout because consumers aren’t as financially overextended as they were in the early 2000s, and excessive borrowing doesn’t appear to be fueling the current price rally, the Fed said.

I don’t think that last part is true.

This is all a fake economy.

A house is only worth like $25,000-35,000 in materials. So if it is selling at $3 million, you have something different happening.

I can tell you what happened: it’s called “inflation.”

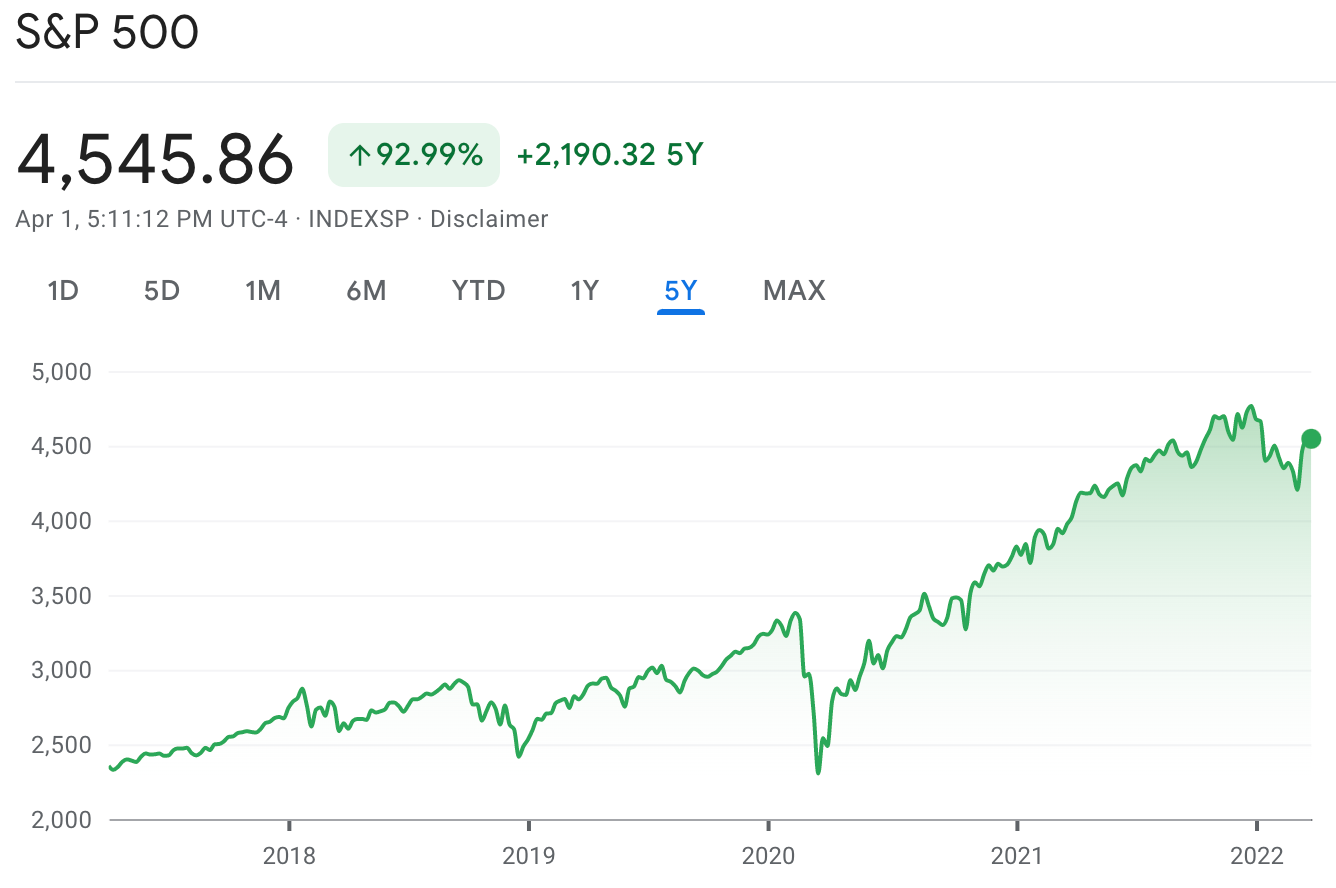

When the dollar stops holding value and interest rates are ultra low, people start monetizing assets. So, when the fed started printing all this money during the coronavirus, all of that money had to go somewhere. So it went into the prices of stocks and property. Plus crypto and collectibles and everything else. I saw someone post that although his house’s value has gone up drastically, his classic Porsche 911 is worth more than his house.

This is something that the government is supposed to manage, to allow money to be a stable means of exchange, which prevents bubbles. To be printing infinity money and have infinitely low interest rates means that the money cannot maintain its value, so people put the money into real and financial assets, and thus you get bubbles.

If it was not for the money having the outlet of pouring into these bubbles, you would have $70 gallons of milk by now.

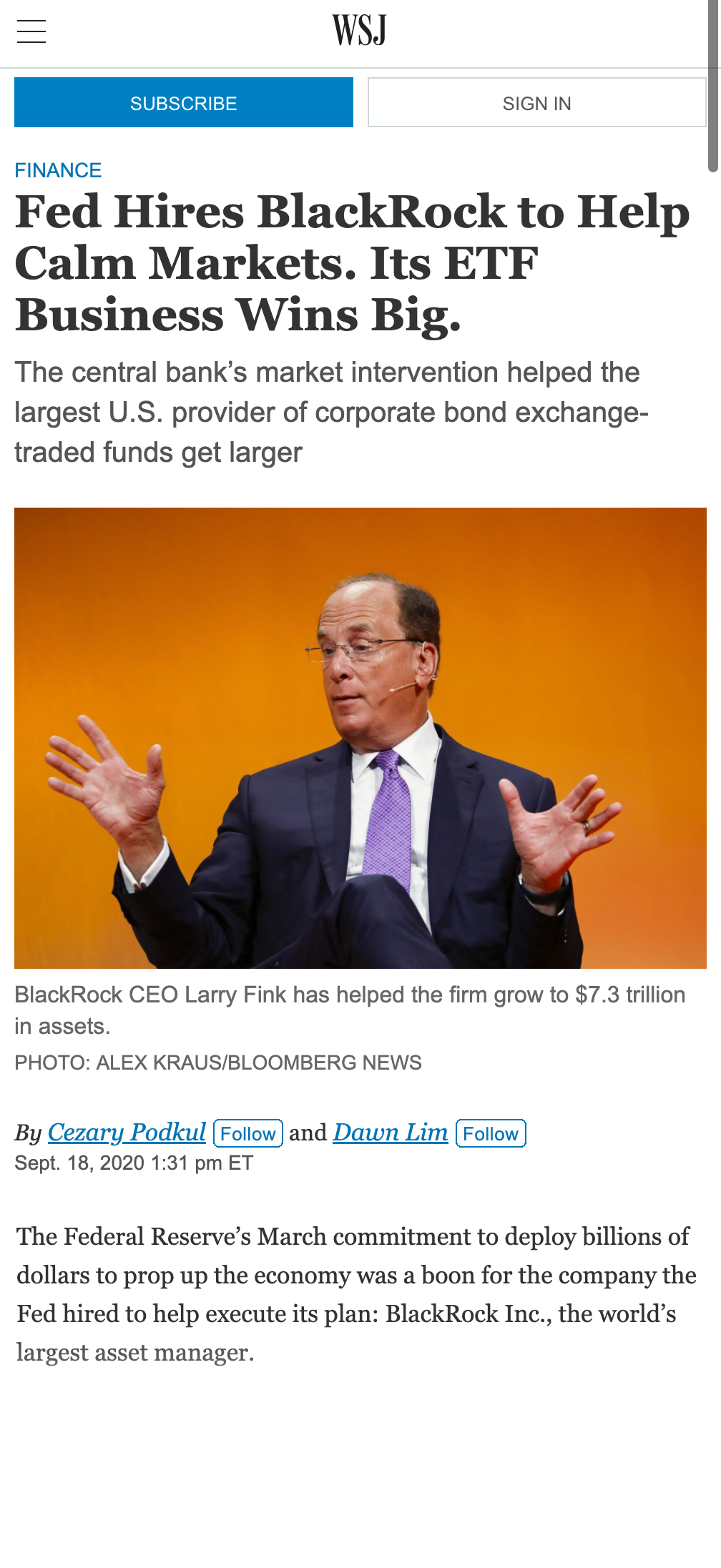

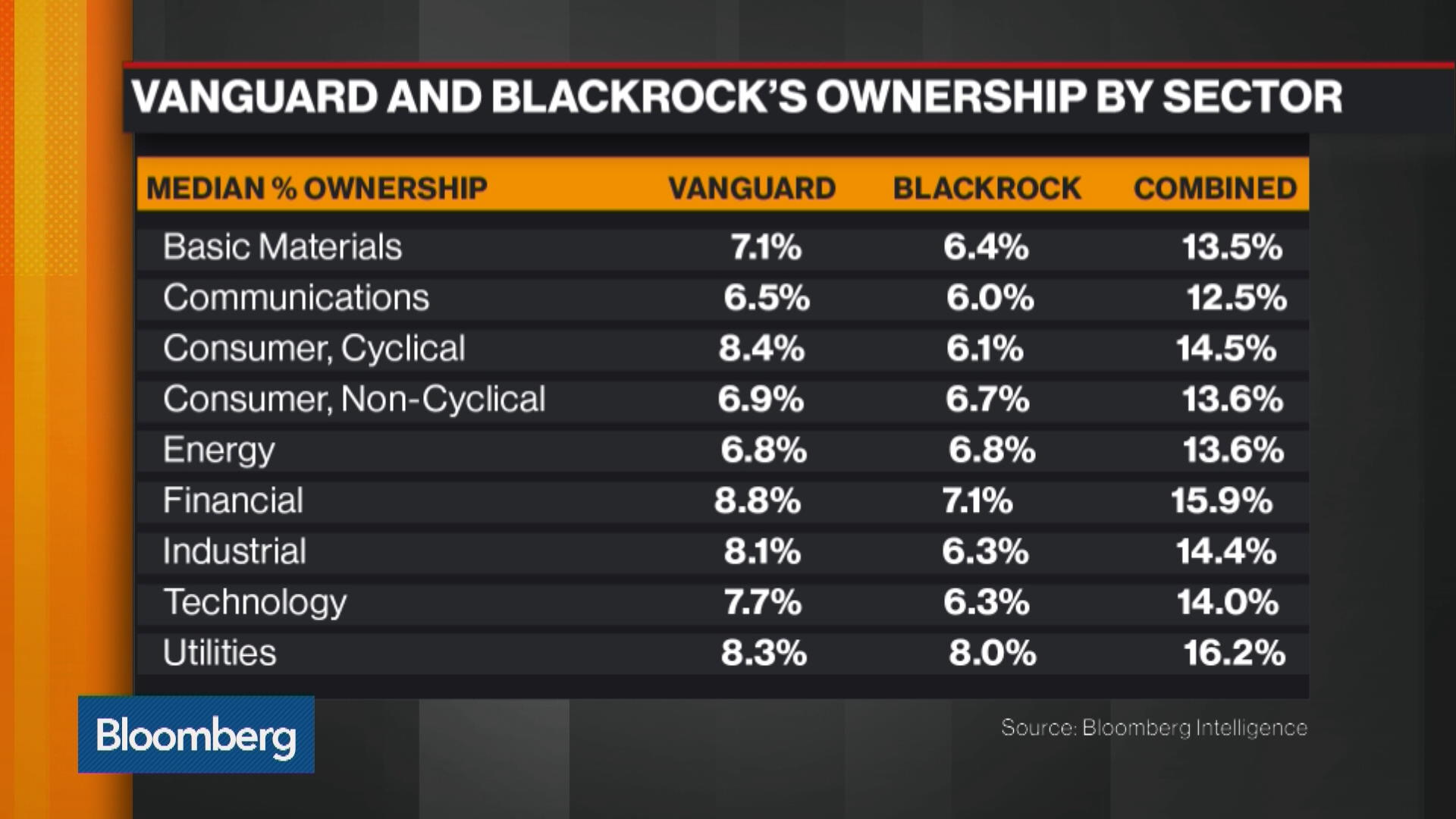

Apparently, the theory was that inflation on consumer goods would be slowed by the formation of these bubbles, and then you could just slowly let the inflation leak out of the bubbles while also making housing totally unaffordable and blocking everyone but the ultra-rich from participating in the economy. Then, you could huddle people into tenements and give them digital credits to buy food made from bugs and digital media subscriptions – all from companies run by BlackRock and Vanguard, which are effectively instruments of the government, via majority stake.

It’s basically public-private communism.

However, it appears that this entire program is going to be totally derailed by the morality campaign against Russia, which is going to end the dollar as the world reserve currency, which will mean that no matter how much you print, it’s not going to be enough. Because the reason this was all possible in the first place was due to the ability for the US to export their debt in this global trade system.

Analogy

These sanctions on Russia were not thought through very well. The US is like a 65-year-old used car salesman with bad plastic surgery and hair plugs and disco clothes hanging around at a college bar trying to pick up chicks.

Except in that analogy, the old guy could run into some drunk chick with daddy issues. If the US was that guy, they would have to have chicks swarming around them like bees to honey for their plan to work.

https://twitter.com/georgegalloway/status/1510188522485002244

The global bees are not swarming the US Ukrainian morality campaign honey.

So then, the old used car salesman with the plastic surgery and hair plugs and disco clothes starts threatening all the cute 19-year-olds at the bar: “you’d better all have sex with me… or there will be consequences!”

Then he corners the hottest girl in the bar, pulls an old rusty Colt 45 from his disco jacket and points it at her and says:

Import issues remain. You MUST:

- Give me a foot massage

- Give me a blowjob

- Drop out of school and live in my basement

- Help me do my taxes

How is that going to go over?

https://twitter.com/vonderleyen/status/1509887202595160073

How is that going to go over with the rest of the people in the college bar?

Are they all going to rally around the greasy senior used car salesman, and support him?

Probably no.

I don’t think so.