Last Thursday, the Jewish Treasury Secretary Janet Yellen specifically claimed that there will not be hyperinflation.

This comment seems to have largely slipped under the radar, but it’s a pretty big deal for someone in her position to acknowledge the possibility of the worst conceivable outcome by denying it.

U.S. Treasury Secretary Janet Yellen faced a barrage of questions on inflation, irresponsible money printing, and employment shortages during her testimony before the House Ways and Means Committee.

“I do not believe we are at risk of hyperinflation. We had several months of high inflation, which most economists, including me, believe will be transitory as our economy gets back in full swing after the pandemic,” Yellen said.

The Treasury Secretary did admit that inflation is higher than anticipated but did maintain her stance that the price increases are transitory.

“Administration budget, which was produced in February, projected inflation at 2.1% at 2021. Clearly, in recent months inflation has been higher than that. Important to remember that it follows a period when prices collapsed after the pandemic shutdown economy. Part of high inflation we’ve seen in recent months reflects that,” she stated.

When asked about the effects of high inflation on different population sectors, Yellen admitted that the Treasury had not done any specific analysis.

“The Fed has established a goal of 2% inflation on average and has done a great deal to justify why that is a sensible goal,” she said. “What I am supportive of is inflation in line with Fed’s target and interest rates at slightly higher levels that would give Fed ability to use monetary policy to address any weakness in the economy.”

Yellen added that she agrees with Federal Reserve Chair Jerome Powell’s comments on the transitory factors of inflation.

“We are seeing huge shifts in demand away from services and towards goods, and now back to services. The economy is suffering from a number of bottlenecks — shortages of semi-conductors, lumber shortages. This is a bumpy reopening,” she said.

When pressed to give a date when inflation could decelerate, Yellen was not able to provide a clear timeline.

These people are claiming that the economy is going to be better because of the economic collapse caused by their coronavirus hoax. That does not make any basic sense. The basic reality we are looking at is that a whole ton of people are completely refusing to work.

There is nothing going on in the economy, and now all of this middle class wealth has been sucked out with a vacuum by the billionaires, the banks and the multinational corporations.

The only thing that is going up in the economy are bubbles – the stock market and real estate. The only way the economy is going to be “strong” is if those bubbles not only maintain themselves, but actually get significantly bigger.

Does that seem like a good plan?

I think it is not a great plan.

I advise everyone to get familiar with Bitcoin. I do not advise investment, as a rule, but as we are eventually, as a matter of fact, facing hyperinflation, you should at least understand how crypto works. There is a zero percent chance you are going to regret that.

The single piece of economic advice I do give is this: buy land outside of the city. That is not really economic advice, it is life advice. I am certain that land outside of the city will do you well financially, and I do not believe anyone can question that. But more importantly, it will provide you with safety when the blacks and the vaxxers come for you.

China is continuing to drive down the value of Bitcoin with various forms of bans on mining.

https://twitter.com/michael_saylor/status/1406226416195321858

However, this mining equipment is all getting shipped out of China to other places.

https://twitter.com/onlyyoontv/status/1406911193126785026

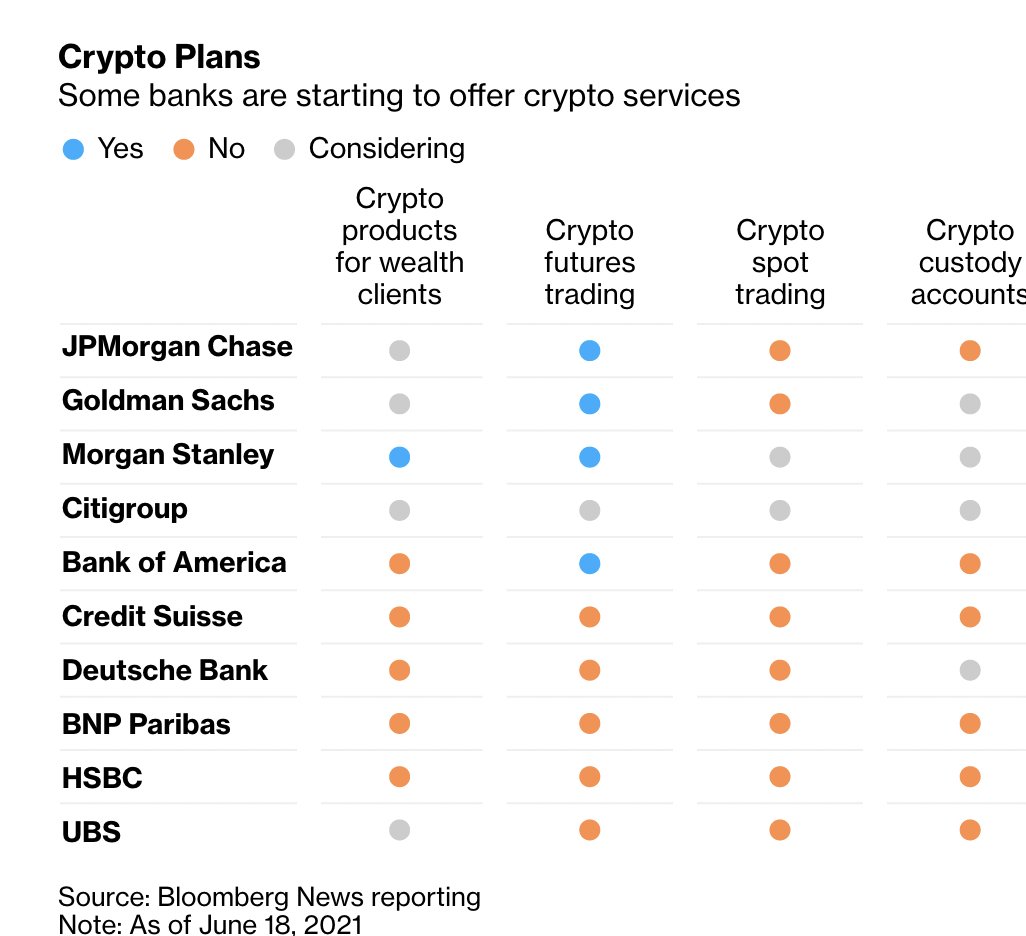

Meanwhile, we are seeing more institutional investment in Bitcoin than ever before.

https://twitter.com/CoinDesk/status/1407022683263483908

https://twitter.com/balance_canada/status/1407009574419369985

https://twitter.com/DocumentingBTC/status/1407036032386805767

Even Big Jew is going in deep.

Meanwhile, it’s not just El Salvador – every Latin American country is trying to get on board, as is Africa and the rest of the third world.

Bitcoin transactions are now just normal everywhere in the third world.

https://twitter.com/DocumentingBTC/status/1407049623424966659

What does all of this mean?

Well, it looks like the price drop is manufactured. Even China itself has a big reason to drive down the price – they have made a lot of money on Bitcoin, and there is always room to make a lot more. We do not know that these mines are actually being permanently closed down on any real scale. We just know that they are saying that and selling some old equipment.

China has a history with this sort of thing, frankly.

https://twitter.com/ScottZILWarrior/status/1407044151389085698

I am not saying buy.

In fact, I think it is almost certainly going lower, possibly much lower.

But the long term?

It is clear that it is much too late for the US to put out a central bank digital currency (CBDC). It took China more than 5 years to develop theirs, and the US hasn’t started developing theirs yet. It might not take them 5 years. Who knows? What it does appear is that there is going to be hyperinflation, and that is going to happen before the US can come in with a CBDC.

Even if they create their CBDC, it is only going to be of relative value, as it is only going to be used by proles who get their allowance from the government. We are going into a total communist system – for the proles.

If you don’t want to be trapped in a government allowance system, you’re not going to be satisfied with the US CBDC.