In the media, everything is some kind of dumb, fake reality.

It never ends, and actually intensifies every day.

(Protip for newbs: “Shiller” [or “Schiller”] is basically an exclusively Jewish name, and it appears to be the origin of the word “shill.” That said, to be fair, this Shill claims to have been “raised Methodist.”)

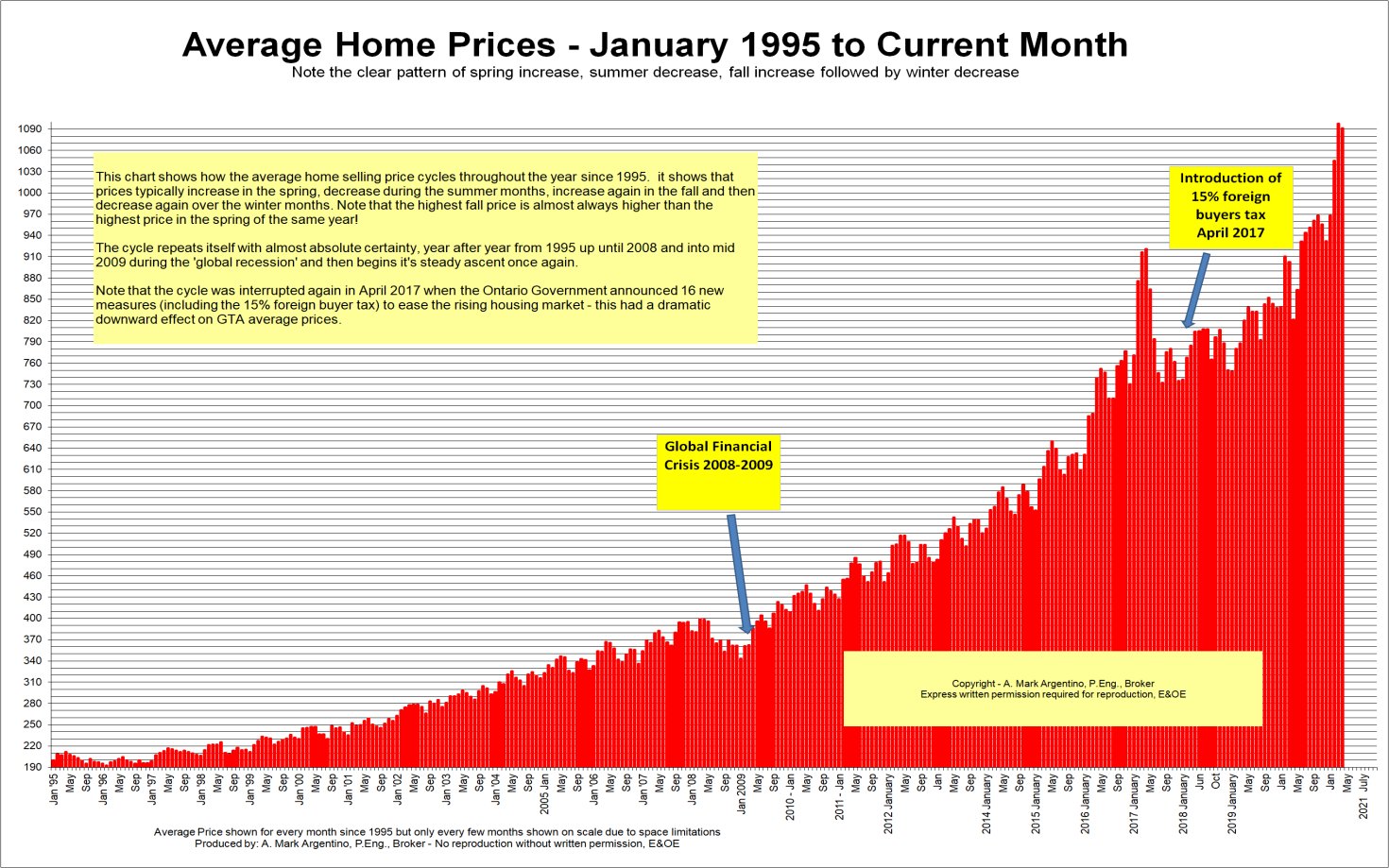

Despite four straight months of record-breaking increases, home prices could end up reversing course in the next few years, according to one expert.

“There is a chance that we will see big declines in coming years,” Yale Professor of Economics Robert J. Shiller said on Yahoo Finance Live. “I think people are anxious about that at this point in history.”

In July, housing values jumped 19.7% year over year, up from 18.7% in June and the fourth month in a row setting record high growth, according to the S&P CoreLogic Case-Shiller national home price index. The 20-City Composite grew 19.9% in July, up from 19.1% a month earlier and just shy of analysts’ expectations of a 20% annual gain, according to Bloomberg consensus estimates.

“It’s surprising the timing of this,” Shiller said. “It came starting in a recession. We’re supposed to be depressed and yet we seem to be exuberant in the market.”

He gives “three driving factors,” two of which are stupid and fake, the other one of which is obvious and irrelevant.

First, mortgage rates are near historic lows and have been during the span of the pandemic.

Most recently, the rate on the 30-year fixed mortgage — the most common among homebuyers — was 2.88% last week, according to Freddie Mac. The rate hit an all-time low of 2.65% in January of this year.

“It is partly due to low interest rates, of course, and Fed policy,” he said. “But it’s so pervasive … I think it has something do with our psychology at this point in history, maybe emerging from a COVID-19 pandemic.”

He noted that many people may be feeling frustrated during the pandemic, forced to work and learn from home, and buying a house is akin to taking action.

“We want to do something,” he said. “So that seems to be ‘let’s upgrade our house.’”

Last, Shiller said that FOMO — or fear of missing out — could be behind many decisions by homebuyers to jump in the market as they watch anxiously as prices accelerate.

It’s just lunacy to talk like this.

He just vaguely mentions “fed policy” in relation to interest rates, but the fact is that since the coronavirus hoax began, the total global supply of US dollars has probably more than doubled.

This has caused people to be forced to “monetize” assets, in particular stocks and real estate.

I have no idea if the price of housing is going to collapse, but if it does, the entire economic system will collapse, and the total concept of pricing things in dollars will more or less become irrelevant.

But this shilling from Shiller is the kind of tripe that normal Americans gobble up. Normal Americans do not even understand basic concepts of supply and demand, or the monetization of assets as a result of inflating a fiat currency.

I’m no economics expert, but you do not have to be an economics expert to understand that when the money supply is increased, people look for stores of value other than cash, and that the more the money supply is increased, the higher the value of the non-cash hard assets.

Instead, the Jew tells the goyim that while we’re in the midst of an economic collapse, we’re also in the midst of an economic boom.

Obviously, this is retard-tier. You couldn’t get away with this on Bloomberg TV or CNBC. But a lot of stupid goyim read stuff like this and say “a-ha! I guess I should sell my home at this high price and save the dollars!”

I’m not an economics advisor, but personally, I would rather own rural property than any stock. I also have an interest in these newfangled “cryptocurrencies.” But I would not have any more dollars than I need to spend in a particular week.

The media is not going to tell you the truth about what is going on with the money supply, but just look at these real estate and stock prices, and it doesn’t take much to grasp the concept.

If the money comes out of real estate, and enters into general circulation, you’re going to be looking at $150 sandwiches.

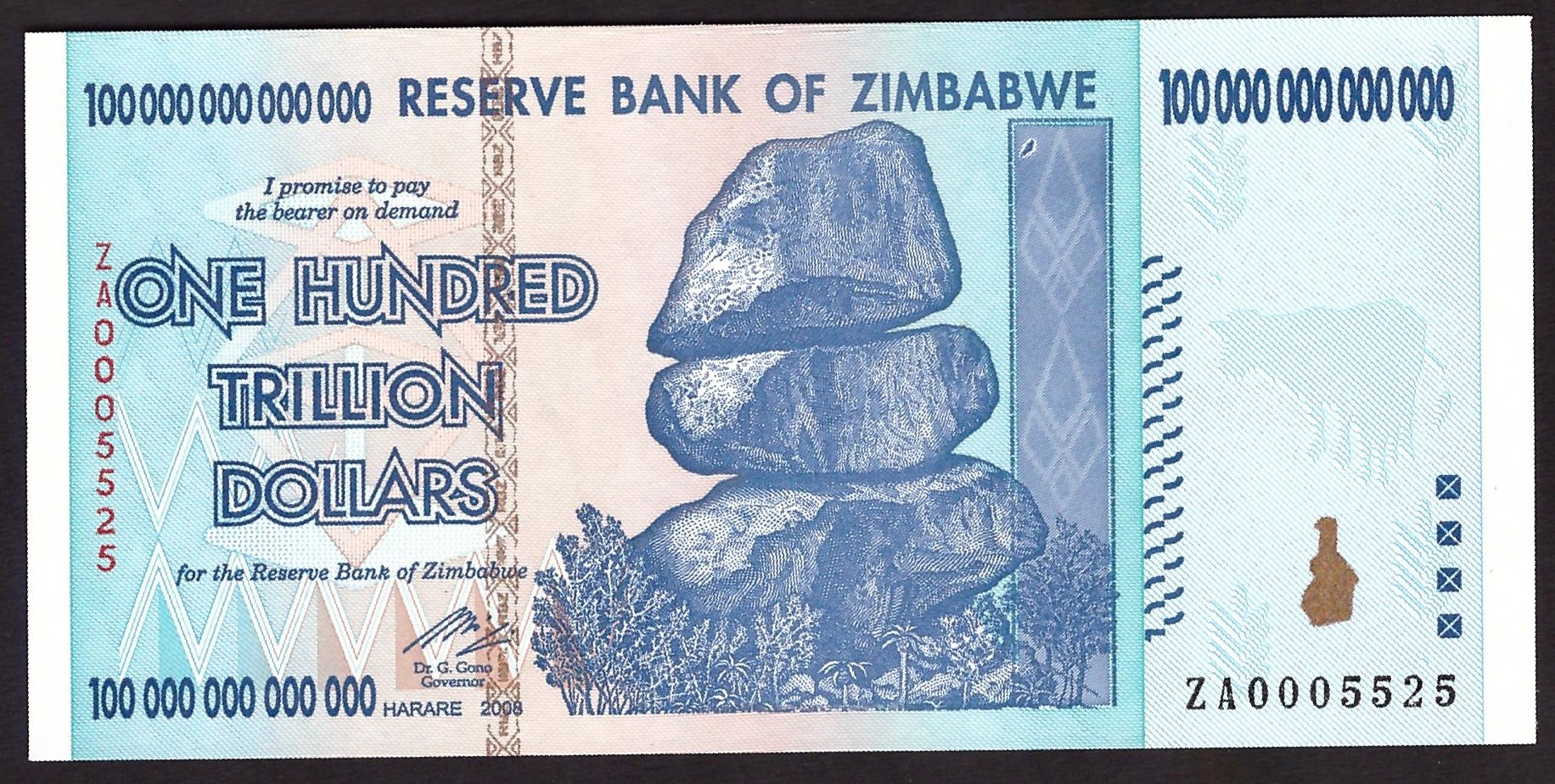

At some point, the money literally becomes worth less than the paper it is printed on.

This is not a meme:

It is just what happens when governments pay off debts by printing money.

The fact that the dollar is the global reserve currency cannot protect us forever. Especially when the Chinese and Russians decide to figure out their own reserve currency, or when Bitcoin adoption crosses a certain threshold.