Andrew Anglin

Daily Stormer

March 29, 2020

For some reason – I guess to try to stand out as not so boring – Forbes has a regular opinion columnist that is an old school Ron Paul type economic doomer. Billy Bambrough writes about bitcoin, primarily, but he has a piece up today that is getting some traction about how the dollar is going to collapse because at the end of the Coronavirus situation the fed will have printed $10 trillion in new money. He of course uses the opportunity to pump bitcoin as the safe alternative, as all young libertarians do these days.

I don’t really know if I’d put much weight at all in these kinds of predictions, but they’re interesting to look at.

Honestly, a different doomer view is welcome after hearing all of the stupid doomer views about the virus itself, which is a dumb hoax.

It’s been an historic week for the U.S. with president Donald Trump signing a record $2.2 trillion coronavirus-induced emergency stimulus package.

The massive cross-party rescue deal is designed to help Americans and businesses cope with the economic shutdown caused by the coronavirus COVID-19 pandemic.

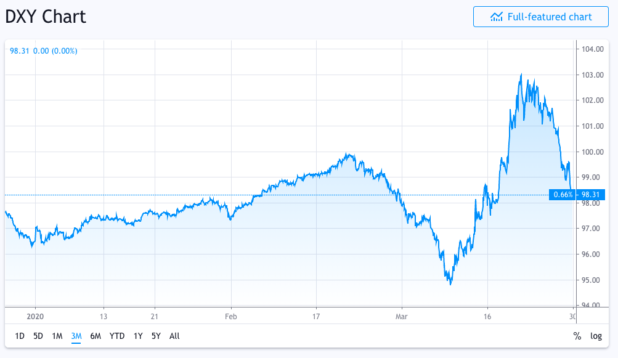

The U.S. dollar has taken a beating, however, dropping almost 4% against a basket of currencies this week—its biggest weekly loss since the height of the global financial crisis over 10 years ago.

This week’s losses come on the back of the dollar index’s biggest weekly gain since the financial crisis, with the dollar surging as investors scrambled for the world’s most liquid currency amid crashing stock and debt markets.

Yeah, it surged and then it dropped.

Hardly spells doom.

“In short-term, huge dollar demand because short-covering, but it won’t last,” Wall Street veteran and founder of Wyoming-based crypto bank Avanti, Caitlin Long, said via Twitter, adding she expects the U.S. Federal Reserve’s balance sheet to top $10 trillion before the coronavirus crisis is over and predicting the dollar’s eventual crash.

On top the of the massive economic aid package, the Fed has been working hard to prop up plunging markets—with mixed results despite its shock-and-awe firepower.

Potential risks of the combined cross-party rescue bill and Fed’s biggest-ever bazooka include out-of-control inflation, the dollar’s displacement as the world’s funding currency, and the complete destabilization of the U.S. financial system.

The Fed pumped over $1 trillion to the system in recent weeks, with its chair Jerome Powell promising never before seen levels of money printing and so-called quantitative easing to infinity through an unlimited bond-buying program.

The Fed has also cut its benchmark interest rate to near zero and made sure commercial banks will continue lending to companies, cities and states—all told the extraordinary measures are expected to grow the Fed’s balance sheet by $4.5 trillion this year.

Throughout and in the aftermath of the global financial crisis the Fed grew its balance sheet by a paltry $3.7 trillion.

“The beautiful thing about our country is $6.2 trillion—because it is 2.2 plus four [combining the Fed’s action and the cross-party rescue bill]—it’s $6.2 trillion, and we can handle that easily because of who we are, what we are,” Trump said, speaking after the bill’s historic White House signing ceremony, and boasting the package was “twice as large” as any prior relief bill.

The bill will see individuals and companies whose livelihoods and businesses have been affected by the coronavirus pandemic receive direct payments, with every American earning less than $75,000 per year picking up a one off payment of $1,200, as well as $500 per child.

“It’s our money; we are the ones, it’s our currency,” Trump said.

Critics of the historic stimulus measures have warned about the possibility of inflation, with many in the bitcoin and cryptocurrency community urging people to explore scarce digital assets.

“Fiat money is getting more plentiful. Bitcoin is getting more scarce,” Anthony Pompliano, a well-known bitcoin advocate and partner at bitcoin and crypto-focused hedge fund Morgan Creek Digital, said via Twitter, alluding to bitcoin’s upcoming May halving event where the supply of new bitcoin being created will be cut by half overnight and putting bitcoin directly at odds with the Fed’s money printing program.

I don’t think that we’re going to enter into any kind of Zimbabwe style hyper-inflation because of 6.2 or 10 or however many trillions of dollars being printed. Basically, these people at the fed know what they’re doing with this stuff, and unless they want that to happen for some reason, it won’t happen.

There are a number of reasons they would want it to happen, but a larger number of reasons they would want it to not happen. In particular, this whole war with China would have to be put on hold, and I don’t think that is something that anyone in the power structure of the US government wants.

Still, it is obvious that we’re looking at a situation that will be worse than the 2008 situation, by a significant margin.

People are going to need to ask if embracing the hysteria for the temporary euphoria that embracing hysteria creates was the right choice.